Judy Weader: [00:00:00] Okay, I think we are ready to get started. Welcome everybody. My name is Judy Weader and I’m a principal analyst with Forrester’s Customer Experience Research Team. And I am delighted to get to welcome my friends from Prudential today. They were actually on stage last year, so we’re gonna talk about that a little bit too.

But before we get going really into the meat of the questions. Let’s start Abhii over here. I’d love for you to, first feel welcome back to the Medallia stage. Thank you. And I’d like for you to introduce yourself and talk a bit about your CX program and really what’s different from last year to this year.

Understanding that maybe not everybody has even seen you ’cause they may not have been at Medallia experience last year.

Abhii Parakh: Okay, good afternoon everybody. It’s nice to see all of you today. I’m Abhii Parakh. I lead customer experience at Prudential. Before I get into the CX program and all of that, let me just introduce you to Prudential because I understand while it’s a well-known brand, some of you might not be familiar with what [00:01:00] Prudential actually does, and it’s important to have that context, so Prudential is a 100 and 50-year-old company. We provide insurance protection, reti retirement security. To 50 million customers across 50 countries globally. We are also one of the top 10 asset managers in the country. The customer experience team that I lead is a centralized team across all of our businesses, and we aim to deliver flawless customer experiences that meet our customers needs, but also drive business growth.

And that, that involves listening to customers, of course wherever they are. We work with Medallia to do that, and it also involves. Taking action, enabling action on that feedback across every moment that matters in our customers, advisors and clients’ journeys. So we have a lot of different types of stakeholders that we have to address and we have to design with intent.

So we have the design team as [00:02:00] part of the cx program. And lastly, the team owns the company website, prudential.com. To your question about, being on the stage last year and what has changed a lot has happened since last year. Last year I was on this stage talking about. How two years into our customer obsessed transformation, we were seeing a lot of results, outcomes, and dividends for our customers and our company.

And since then, number one, as I said, Prudential turned 150 years old about a month ago. So that was a really special moment for all of us. A happy birthday to Prudential. The second thing was we had. Established, not net promoter score, as I’m sure a lot of you have as our beacon metric, but we also measure a lot of different customer experience metrics, like ease of doing business, csat, et cetera, and I’m happy to announce that our net promoter score, we blew past our target record score and also on ease of doing business.

For our digital in service experiences we hit new highs and [00:03:00] records as well. So we’re really proud of the progress there. And lastly Forster, we won Forster’s coveted.

Judy Weader: Customer Obsessed Enterprise

Abhii Parakh: Award. So really proud about that. I’m just really privileged to be able to work with such a great team, great talent, capabilities that we built and fantastic partners like Carolyn.

Carolynn Smith: Yes, and good afternoon. I wanna say good morning ’cause I’m just getting off of a flight. Good afternoon. Carolyn Smith. I have the pleasure of working very closely with Abhii in my role as the head of us. Service operations. So my organization handles the servicing of our retail and institutional businesses, which encompass our customers directly, employers, clients, and advisors.

I’m responsible for the run and the transformation of the service experience to make sure that we’re evolving the way that we show up in market. That we’re evolving the capabilities to meet the ongoing demands so that we can achieve the targets that we set. We like to pride [00:04:00] ourselves on being a customer obsessed organization which means that we drive accountability for the outcomes all the way down to the front line.

I have the absolute pleasure of having Abhii as a partner. Abhii’s capabilities span from journey management. To designers and then our overall voice of the customer program and our partnership with Medallia. So he has been a key partner in the turnaround of the service organization relative to becoming top-notch in the industry.

Judy Weader: So we’ve talked about customer obsession. Just show of hands, who is familiar with the term customer obsession? Oh wow. Actually a good number. Okay. For those of you that are not familiar with it it’s a term that Forrester has used in its research for a number of years, and it refers to a perpetual business orientation where you put your customer at the center of your leadership, your strategy, and your operations.

So we’re really talking about orienting on that customer. It doesn’t mean we’re forgetting that we’re a business, but it means that we’re thinking very clearly about the customer, their needs, and [00:05:00] we’re folding that into every decision that we’re making. Now if we go back to that customer obsessed enterprise award that you won last year, I would love for you to talk about, what got you to that win.

And also, if you think about it, how do you keep the momentum going? ’cause that’s a lot of work.

Abhii Parakh: Yeah. Look for our 150. Years of existence. Prudential has always been a customer obsessed company, right? Sometimes you need to inject reminders and reignite the spark, but we have always been customer obsessed.

And by the way, you don’t survive and thrive for 150 years as a company if you are not customer obsessed, right? So what got us the award last year, I would say. Customer obsession is a cultural imperative that then drives business results, right? We spoke about some of the results, the record highs and the metrics.

And by the way, we do pulse surveys with our employees, and they have never been more motivated about and educated about what our customers need. But all that comes [00:06:00] from the cultural shift. So let’s talk about culture. What is culture? Culture is made up of beliefs, right? For any community.

There’s a certain set of beliefs. There are rituals, right? Like the community goes to church or they go to a place of worship or some other town hall gathering regularly. And then there are artifacts, right? They have a constitution in place or a charter or something like that. Beliefs, rituals, and artifacts.

Super important to get the culture codified. So to codify our customer obsession into our culture. Those were some of the things. That, that we’ve done. So the belief in customer obsession in our company is very strong at the highest levels. We were just talking about our CEO and our head of all global businesses, extreme level of sponsorship and belief in customer obsession, and that culture comes from the top down.

Then in terms of rituals, we’ve. Put into place a number of things that I believe led us to win this award, which I haven’t seen in many [00:07:00] other places being done at that level. So first I would say we have an annual gathering conference internally for customer experience. It’s a global conference.

We had at a thousand people attend that conference. Last year, every business function comes to that conference. We take the time every year to celebrate our customer experience wins, learn from the outside in, and then set the trajectory and momentum for next year. So that helps us keep that momentum going.

We have a quarterly, just like you have earnings calls for public companies, we actually do quarterly internal voice of customer calls. For all of our employees, right? So we about 1800 or 2000 employees every quarter voluntarily joining these calls to listen to customer feedback. And these are not calls that are just customer experience teams talking about it.

We have business precedents in every call. We have service, sales, operations, all the teams that need to come together, [00:08:00] technology to drive difference in our customer’s lives. And we talk about feedback and the action we’re taking. So that’s a regular codified into our culture thing. And then of course, at the monthly level, more tactically, business leadership teams talk and take action and they talk about what it will take to make a difference.

And that gets codified in our CX action plan, which is an artifact. So it’s the belief top down. It’s the routines that we’ve put into place as well as those artifacts that are now consistent across our business system.

Judy Weader: And then picking up from that Align conference, which I was actually very lucky to be able to attend last year and speak at lots of people there, lots of people coming in virtually.

So that was day two. Can you talk about day one a little bit, because that was the poster session I. And I think that’s interesting, like the way that you’re getting other people involved.

Abhii Parakh: Yeah. Thank you Judy. And thank you being such a advocate in coming to the, to experience what we have. So it’s a two day conference, right?

And it’s on CX Day around customer service week. [00:09:00] All of that happens around October timeframe. This year we’re scheduled for October 8th which is the day of the conference. But a day before the conference is what we call the Customer Experience Expo. So this is a science fair for CX people.

So basically what happens is in the lobby of a building where everybody’s coming into work in the morning, we set up shop, we invite everybody to set up boots. S and talk about the experiences that they created, how they made their customers advisors lives better in the last year. So everybody coming into work that day, which we choose a day where we know a lot of people will come into work.

We have that sort of expo happening throughout the day. We have workshops and training sessions. We have vendors and partners, Medallia is a constant presence there. And so we have that energy. Built up in the lobby of the building and then that energy goes up in through the elevators, through all the floors throughout the day and culminates into the conference the next day.

Judy Weader: Yeah. So another really cool thing, if you think about the number of [00:10:00] people that are involved in this, it’s also showing it’s not just Abhii and his team that are doing this. It’s everywhere in the company, so really germinating it. So then going back to something you had said much earlier, you talked about growth.

Prudential is a firm that wants to grow. So how is your customer obsession, transformation, driving growth? For Prudential,

Carolynn Smith: four years, we looked at service as an expense center, right? As it’s a service organization, we have to handle transactions from customers, and there have been plenty of studies that have been done that talk about service.

Experience and the impact to brand recognition and brand loyalty. So there is a correlation in how people view our brand in relation to how they feel when they interact with us. We have over 5 million interactions a year, and our focus has been specifically on ease. We wanna make it easy to do business with Prudential.

That has been a very clear goal for our organization. And when we say ease, we think of interact service interactions as how do we anticipate the customer’s [00:11:00] needs? What we were really good at is reacting to it. We call it firefighting, and the service operations. I see a lot of head nodding. Really good at it.

And we had to shift. The culture to one of how do we anticipate their needs by leveraging data to proactively engage with them so that they don’t have to call us or they don’t have to do something with us. That puts effort on their end. In addition to that, in parallel we run with. How do we create capabilities that meet them on their terms, whether it’s the mobile device, whether it’s a website, but how do we create capability where they can choose the channel in which they wanna engage?

What we’re being very careful about is not to over club digital and automation, because human empathy is, and I believe we’ll still continue to be very important in the interactions we have. We see survey results now when we’re paying a death claim or somebody has a disability claim or starts their retirement stream of income that are saying, wow, I, I can’t wait to continue to invest with you.

I can’t wait to continue to [00:12:00] purchase another product. So we’re seeing a direct correlation again, an ease of doing business. The ability for customers to promote our brand, and then revenue and sales for our company that make people want to come back and do business with us. So it’s very important.

But it’s a, it was a pivotal shift in the cultural foundation that Abhii’s team has helped us create across the company. We measure what matters and then we reward the behavior. So compensation every year has an element of NPS to it. It’s amazing what people will do when their compensation and the rewards program is directly connected to an outcome.

Judy Weader: Now, I’m contractually obligated as a Forester employee to say we do not recommend tying compensation to things like NPS. However, there are ways you can do it in a manner that it doesn’t lead to people trying to game the system. Correct. So I think that’s really the big thing. If you wanna use a reward, you need to make sure it’s not something where someone’s gonna do things.

Like what I’ve seen I had a dealership that I used to go to where they’d say, if you give me anything less than a nine, [00:13:00] it’s a fail. Okay. That’s a huge amount of pressure on me. And maybe they only deserved an eight, but now I feel like I have to give them a nine. Or someone’s going to take their children from them.

So it’s, you have to think about that. I have to chime in here.

Abhii Parakh: Yeah. So we had several conversations three or more years ago. Of course, Forrester is a very trusted partner when it comes to cx. When we were kicking off our transformation, those were the questions Yeah. That we were wrestling with.

Should we not, how will we incent people? How do we change that? We had a lot of conversations with folks like Judy and we learned that that there were some really bad use cases of doing this, where the customer service associates pay was tied to NPS and how it was getting gamified, and we wanted to stay away from that.

So what we did, just everybody knows at Prudential, we aggregate. In the spirit of teamwork, we aggregate all of our NPS and it gets into one number that is not publicly shared. ’cause it doesn’t mean anything. The only reason for that is that aggregate number is used in the calculation for our composite compensation [00:14:00] over, across the company globally, no one is individually incentivized and no one can individually game the system. Everybody has to chip in to make that happen. And that drives a lot of teamwork and we think it works for us,

Judy Weader: and that’s a much smarter way to pull it away from the individual.

Absolutely.

Carolynn Smith: I think the important piece too, I think you have to have a certain level of maturity and governance before you take that step. From a programmatic perspective, ’cause it’s not something you would do at the onset of attempting to become customer obsessed. But once you have the measurements, the governance and the methodologies in place, it’s something that you should strongly consider.

Judy Weader: Yeah, that’s a really good point. So that’s a great segue into the next question I had for you, which is about your customer obsessed transformation. What challenges have you run into and how did you overcome them? Or how are you still trying to overcome them?

Abhii Parakh: I was just talking to someone and saying transformation is a hero’s journey.

It’s a gauntlet. It feels incredibly hard some days. And you feel like you’re taking a step [00:15:00] back, but then as long as you’re making two steps ahead to make up for that. So it really is a gauntlet and there are a lot of challenges. But I would say all of those are opportunities. I know it’s like super cliche, challenges and opportunities, but the opportunity.

So we have something really good at Prudential, which is the leaf system around customer obsession, driving growth, the sponsorship that’s really good at the macro level, that’s really great. But when you come down to it in the day-to-day decisions, businesses become what they prioritize. So if you’re not gonna prioritize the things that matter to move the needle for the customers there’s no point in listening to them. ’cause you’re not taking action. Where the rubber meets the road is where the opportunity is. And to do that in a very realistic way, and Carolyn and I have had discussions about this, is how do we prove the ROI, right? Because you are going up against, in these prioritization battles, sales initiatives that are gonna drive revenue.

You’re going against [00:16:00] service initiatives that might drive costs down. That’s right. So how do you say that this customer experience initiative that is geared to drive you NPS is going to impact those levers? ’cause at the macro level, we have proven that people who are promoters, whether they’re advisors or customers, are actually 200% more valuable than detractors.

So we have that correlation. It’s not causation, but when it comes down to the initiative level, I think we have work to be done to be established that ROI for some of our biggest projects, so they can hold their own in the prioritization rooms.

Carolynn Smith: Yeah, I think that is, that was one of the. The key changes we had to make is look at our investments through the lens of experience and waiting certain factors to make sure we were putting our money where our mouth was to drive the right transformation, and then capturing the essence of the impact of experience, knowing that ultimately experience will impact if done right, the efficiency your organization can gain as well as your revenue.

Judy Weader: Speaking [00:17:00] of efficiency. And customer service. I know customer service is a huge piece. It’s very important for Prudential to provide great service and it’s part of what it cares about when it comes to its customers. And when it comes to its advisors, so with customer obsession in mind and all that, how are you thinking about service today?

How are you thinking about it for the future?

Carolynn Smith: Yeah, it’s constant learning. In partnership with abi. We’ve done a lot of listening posts and when we say listening posts, the ability to capture feedback on things that we’re developing, let’s say, using a transactional type a certain way, and their segmentation of customers, and there’s behaviors that you have to appreciate and respect.

You have to be willing to learn and learn quick and then pivot your transformation and investments because customer service as we know it, is being completely in a very good way, disrupt it. There is gen ai, there’s agent ai. I mean you to keep up with the growing evolution of how people expect to do service.

There’s a lot of testing. We [00:18:00] learn quickly and then we figure out where do we scale based on the demand. So you have to have a very close connection to customer feedback. And I would call it micromanaging to some regard, but we go daily at the customer feedback of capabilities that we’re building. We offer channel optionality that is very important.

You can’t overs swing the digital, especially in key moments of people’s lives, like a death claim, like a disability claim. We need to make sure that we’re infusing the right mix of new capabilities, AI and automation. With that of human empathy, there isn’t a secret to what is the perfected mix of it, but listening to the customers will inform the direction that we continue to take.

Judy Weader: So then sticking on AI for a couple minutes. This is an area that’s changing pretty much constantly. How do you keep up? How do you identify which things you wanna work on and which technologies you wanna chase? Do you have AI governance? What are the things that you’ve set up?

To make it, to support the work that you’re trying to do. [00:19:00]

Carolynn Smith: Yeah. We have a significant amount of AI governance as we’re learning. What do we use internally? What are we comfortable exposing externally? One tip I would say is use it yourself. If you haven’t used AI in your personal life or your, IT will completely change the way you spend your time.

It may also help you connect dots in your professional life of how you might use it. In addition to that, staying connected to what your industry and other industries are doing. There’s a lot of opportunity, especially in my world from a service perspective, where you can think about making interactions more efficient.

So when we think about someone calling a contact center, there are ways to leverage a, the notion of a copilot. To aggregate information from different data sources, from different systems and technologies to make for a more efficient and effective and quality interaction than you can before. That is a recommendation to start internal and then figure out how do you perfect and tune the bot so much that you can expose it externally for use.

[00:20:00] There’s a strategy we have in place and AI governance is a very important element to that. I don’t know if there’s anything to add. Yeah,

Abhii Parakh: I think personally speaking keeping up, there’s so much change, right? Just. Opened my LinkedIn this morning and I saw Chad GPT had launched like a new version of its image generator.

And that is it’s unbelievable what these things can do these days. So it’s, it is hard to keep up. I would say a couple of tips, right? Or what I do personally. One is stay close to your technology partners internally because. To make things happen internally, you’ll have to work with them anyway, so they might already be working on an enterprise solution that you wanna get behind.

So that’s one. But a lot of the learning happens externally. So for example, I would say talk to analysts at Forrester. I have been doing like every two weeks. A new Stephanie Lou. If you guys have Forrester talk to Stephanie. She’s been awesome. We actually brought her into Prudential and she spoke to hundreds of people that we got together from our Digital Guild, our [00:21:00] CX champions program to educate everybody about Agentic ai.

So that’s number one. Number two is talk to your vendors about their roadmaps. So talk to Medallia. Of course, you heard, in the keynotes, what some of the new technologies are, but talk to your vendors about where they’re going, how they’re thinking about it. That’s number two. And then if you can try to start talking to startups, they’re usually at the bleeding edge.

So we have a ventures team that invests in startups. So through them, we took a trip to Palo Alto recently and met with about 10 to 12 startups in the Agentic AI customer experience and service category and. Really blew our minds to the degree, what they’re able to do these days. And some of, so the bigger companies will take some time, but the startups are adopting those, they’re more nimble, right?

So they can bring to life these things. So we’re considering a few proof of concepts with some of those startups now. So those are some of the ways that you can personally [00:22:00] stay up to speed with what’s going on.

Judy Weader: So now if we think about the kind of industry that you’re in, heavily regulated.

And probably the anyone else here in a heavily regulated industry, healthcare, financial. Okay, cool. Oh, a lot of, yeah. So you’re your people. Fantastic. Can you give some specific examples of how you’re using AI right now, or things that you’ve got maybe like close, they’re ramping, but they’re not quite there yet.

Abhii Parakh: Yeah. Carolyn, you wanna

Carolynn Smith: question? Yeah. I’ll start with some service examples. So I, we often like to refer to the engagement funnel as how do we preempt the customer from calling us. With self-service, but I’m gonna talk about an example where it’s down funnel where the customer’s interacting with us with a live customer service representative.

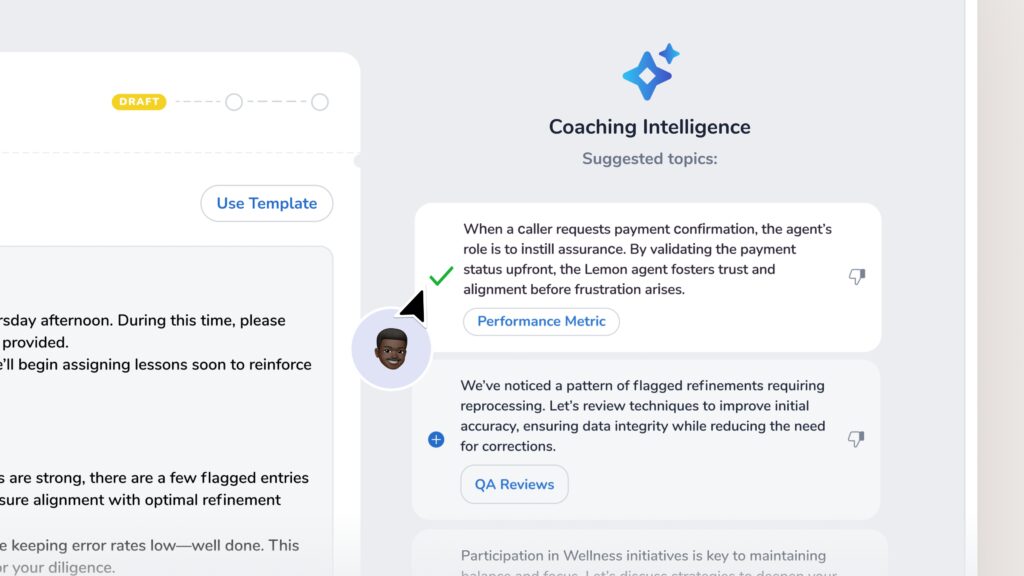

We are leveraging gen AI because right now we have multiple technology solutions with data that’s very disparate. We’ve matured significantly, but there is still a complex environment when it comes to the product. The segment. And the type of claim or interaction that the customer’s requesting. Our Jet ai co-pilot has [00:23:00] the ability to aggregate the data, to have the live transcription of the call happening and it’s proactively pushing content.

So we have a very strong vision around knowledge management, which is we don’t want our service professionals searching for knowledge content. We wanna have it directly embedded into our workflow for proactive next best action with the instruction on how the CSP should navigate the call. That’s very different today, right?

So think about it as live listening. It’s proactively pushing content and it’s guiding the conversation. You get higher quality, you get higher effectiveness, you get better handle time, which yields to better experience and results. So that’s one good example that is very real. And depending on the scale of your contact center could have significant impacts to the way that you show up in market.

Abhii Parakh: Yeah that’s a really great one and again, 150 year old insurance company, but I have never seen us adopting new technology faster than we have in the last, in our hundred 50th year. So that’s a huge testament to the [00:24:00] leadership and leaders like Carolyn that we have in the company. I would just add a few examples from the CX and marketing side.

So the marketing side you guys are familiar with Adobe. They have image generation, so we have completely embraced all of that. For content. We use writer and for image generation, we’re using Adobe’s. We are full stack Adobe marketing organization. Our entire market, MarTech Stack is now Adobe.

We have seen 60 to 75% improvement in speed to market for our campaigns using rider. And Adobe and we are not stopping there. We have a few POCs that we’re starting for marketing compliance and other things with other companies as well. So we are all in on ai. And then I would say on the customer experience side of course we wanna use on the CX platform side, we wanna use some of the advanced AI capabilities, but in the meantime, we have been.

Leveraging existing AI tools like Ryder, we take all the sort of verbatim Tims that we get [00:25:00] from customers and we feed into writer and it summarizes everything for us and we know what the themes are, and of course our platforms will be able to do that when we get access to all that capability. But in the meantime, we’ve created customized apps.

Ourselves to be able to do that. So that has been really helpful. And then the last example I would give is on customer experience research. We do a lot of focus group studies with real customers. We actually have 500 to 600 real prudential life insurance and annuities customers in a community. A very active community that we test with continuously.

And we do focus groups with them and co-create with them. That’s part of our customer obsessed culture. That takes time though, right? Like all those conversations and interviews and there are video recordings. It takes time to synthesize that. We have used AI and we are doing this now. It’s live from weeks.

To hours. That’s the impact that we’re seeing in terms of productivity gains in synthesizing all the insights. So [00:26:00] obviously first when we started that, we did it ourselves and we ran it with AI just to see if there was any hallucinations or things like that. And we’re pretty much one-to-one match. So now we’re scaling that.

Carolynn Smith: You just triggered it. A thought for me. That’s just a tip or a piece of advice when functional areas, the marketing example procure AI solutions. Make sure you’re leaning in to learn about it, because in that example of writer ai, it is scalable to service. So we’re tapping into it because think about the large language models.

You can tune it and you can build it out to rerate customer correspondence. Now again, there’s always a human in the loop aspect of it, but that’s a good opportunity where we brought in a solution with a marketing lens, but it’s scalable to other components of the organization if you truly understand the way that the models are built and how they can be used.

So just. Just a thought I would share. And by the way, when

Abhii Parakh: it’s performance season and you have to do your three sixties, you send out those things asking people for feedback on your people. There’s a lot of that, like pros and cons, like opportunities and strengths that [00:27:00] come in all good. But to go through that would I would have to set aside time.

I just feed all of that to writer and it gives me the summary, the top three strengths, bullet opportunities, and gives me a good summary of what people are talking, whether it’s customers or employees, right? It’s the same functionality that can be used. So it’s made my life more productive as well.

Judy Weader: Excellent. We can talk about almost the weird situation of 150 year old firm that’s also super into technology, right? Yes. Like that it does seem a little bit strange, but what is it beyond the executives, because you mentioned your executives are all in on using technology and, facing the future.

What else? Is it a mindset shift? What, how are you able to adopt technology so rapidly within a large and really well tenured firm and

Abhii Parakh: regulated? Yeah,

Carolynn Smith: and heavily regulated talent. Talent is key. So one of the key things that we really look at assessing is just the mix of tenured talent and experience talent.

So we’re always looking at talent mobility opportunities. There is a mindset component to that as well. The other thing [00:28:00] I would say, Prudential has been on a decade journey. To modernizing data and technology, that has been very important because you cannot put gen AI on bad data, right? You have to be able to have good data, reliable data, accurate data and data that could be ingested and used.

So when we think about our investments in our APIs that we’ve built, we had a lot of legacy. I’m sure many of you have a lot of legacy, and it was how do we modernize the technology? Make the data accessible so that we can fuel the next gen of capabilities. And that has allowed us, I think, to leapfrog in many components.

It’s an investment that’s paying dividends right now because it allows us to plug and play, try different use cases, things that we buy, things that we build. But the architecture. The data environment and the technology modernization has been key to that. So it didn’t happen overnight. I’d say the past 10 years have really been a turning point for us.

Abhii Parakh: And I would just add, going back to my point about culture, it was such a big believer that culture [00:29:00] eats strategy for lunch, right? So from a cultural standpoint at the top of the house, ’cause culture is tops down and buttons up. Tops down. Our executives have really empowered, functional and business leaders to go all in on ai.

So it’s not a, oh, everything has to be done centrally by some AI team. Every business function is open to explore, right? Ask funding for, make the business case and try those new technologies. There is a central governance. That makes sure the risks are looked at and that we aren’t duplicating efforts, but we’re empowering all the teams to adopt this in the best way that they need to.

And the second thing is buttons up. There is healthy skepticism from people when you introduce something new. It’s part of human nature. So instead of fighting that, I think showing. That is the key. So instead of fighting the skepticism, we actually onboarded the technology and then we showed everybody what Adobe could do.

We showed everybody what writer could [00:30:00] do. Actually, that created such a pull from the people. ’cause when they started using it, they were like, I’m not going back. This is amazing. And I’m seeing so much productivity gains, so you have to do it on the both sides. On the tops down. Just one more thing.

We recently had a three day tech and data summit. For the top maybe 200 people in the company, because if the top folks don’t understand. These things, then they’re not gonna be able to sponsor, prioritize and fund some of the things that everybody else wants to do. So that’s also very important.

Judy Weader: So to a certain extent, you’ve jumped the gun on the last question, but I’m gonna ask you for more anyway. Before we get to the q and a, there’re probably folks in this audience who would love to be sitting up here telling their story next year. So what one piece of advice do each of you have that you wish someone had told you maybe one or two years ago?

Abhii Parakh: Carolyn?

Carolynn Smith: Yeah. This I have three specific things that I wanna bundle ’cause they’re so important. Create your vision and your execution roadmap and stay relentlessly focused on it. [00:31:00] There are so many thi shiny things out there that will pull you to deviate from that vision. Stay focused on it. Sounds really easy.

It is not, especially in the world where things are continuously changing. The other thing, customer feedback. Listen frequently and pivot. Don’t ignore the feedback. Make adjustments. You don’t always have it right when you’re building and designing. And then the last thing is measure what matters and create the transparency for the team to track it.

It’s almost like you’re on a diet. You’re on the scale every morning. Measure it daily, monitor it, reward the behavior and recognize it, right? Because this is not a sprint, it’s a marathon when you’re in a transformation. So it’s important you use that information to recognize your teams.

Abhii Parakh: If anybody knows Carolyn, Carolyn is an operational ninja, like nothing slips through the cracks.

She will, she gets her roadmap done. That’s how, thank you.

So I would just, so has anybody, does anybody remember the name of the monkey from Land King? Oh, Rafiki, RAF. [00:32:00] Yeah, Rafiki. Pretty impressive. I actually, this morning I was thinking about this dog. I had to look it up. Rafiki. Yeah, so I just recent, I have two daughters.

They’re five and six. And so we went to see Mo Mufasa, which the, I really liked it. I don’t know, the reviews were mixed, but I really enjoyed it, I think more than the girls. And Rafiki has this really catchy song in the movie. I’m not gonna sing it for you, but I’ll just share it, what the song is.

It’s basically he says. If you wanna go fast, go alone. There’s the door, off you go. If you wanna go far, we go together. And so that is my parting words of wisdom here. Our customer obsessed transformation would not be successful if it was just the CX team or the marketing team, or the service team. We took everybody along.

So we could go far. And I’m really proud of how far we’ve come together.

Judy Weader: I am too. That’s awesome. What a great note to stop on. Before we go to q and a, can we please get some applause for Avi and Carolyn?[00:33:00]

So we have about 10 minutes, which means we can take a few questions. And I see some hands.

Q+A: Hi thank you so much for coming and sharing your wisdom today. I have a little bit more of a tactical question, so I’m curious how you guys prioritized and enabled any sort of governance in your organization so that you could.

Enable this customer obsession? Or was that like, how did you go about that conversation? How do we govern, how do we stay true to our strategy? How do we resource it so that we can do these things? I’m just curious if there’s anything that you feel comfortable sharing

Abhii Parakh: about that I can start when we kicked off the so there are phases, right?

Phases in maturity, and you have to evolve your transformation according. Okay. So when we first started, when the maturity and understanding on some of the things were low, we had, we needed more governance. So we had established and we knew we couldn’t do it, just like the core team couldn’t scale as much.

It’s a very large company. We have 40,000 [00:34:00] employees, 50 countries. So we established a champions network. And the champions became our arms and legs, our advocates in the company and the customer’s advocates in the company. So when we want people to join the voice of Customer call, of course we’ll include it in the company newsletter.

This is happening. But the champions will create challenges and missions for them. They’ll go on missions, creating advocacy, sharing with everybody locally in their teams and hey, this thing is happening. And they’ll have watch parties even we’ve seen that, right? So I think you need some level of governance in the beginning and you need arms and legs entrenched into the company that can then bring that nervous system that sort of signals back.

But as we are getting more mature. I would say we’re empowering much more the businesses to think about their business strategy connected to their customer strategy. And we’ve actually dwindled down the number of people who are working on that [00:35:00] transformation because now a single or maybe two people can work with that Champions Network and the businesses and they are creating their missions on their own.

We have set forward the goals and we have this NPS target and all of that stuff, and we’re asking them, how will you accomplish that?

Judy Weader: Okay, so two questions. First one was on how they train AI models, and the second is on establishing global governance. ’cause it’s a global company.

Carolynn Smith: Yeah.

I’ll start. And I failed to mention this at the beginning, so I I lead the service organization. I sit with data and technology. It’s a strategic important point because the operating model in this case matters. So I sit on the team with the data scientists. The data I mentioned, the data maturity that we have done, the models that we’re building get tuned by the service professionals using them.

So when we think about live pilots, and that’s one reason why we’re doing it internally with a human in the loop for efficiency, is because the tuning is happening with the actual utilization of it in production. So the models are in initially built, but they, [00:36:00] we were getting to a place where we’ll call it eight weeks into a model.

We’re getting at about 96% accuracy. Which is really good on a consistent basis. So that’s at the highest level. I’m not a data scientist, so I know there’s more to that. I’m not intelligent enough to speak to that piece, the governance aspect of this. So there’s your functional governance in terms of recommending a use case.

And determining whether it’s eligible or not, and then what is the business value associated to it? One thing we wanna make sure we do not do is get in A POC Hell, where we’ve got POCs all over the place and we’re not really sure the intent of what we wanna accomplish. So the business case validation, the maturity of the data, the accessibility of the data happens at the functional level.

And then we have an AI governance board that straddles all the data scientists across the company. That includes risk compliance, et cetera, given the regulations. That exists, so does that. Answer your question and I can answer

Abhii Parakh: the second part of the, on the global governance. But Karen, would you say that the we’re model agnostic or [00:37:00] do you think we have a specific preference?

Carolynn Smith: No, I don’t think so. We are tapping into models. We are internally building models. We’re buying, we don’t have the secret sauce yet on what the right blender mix mixes. It isn’t a one size fits all.

Abhii Parakh: Yeah. And then companies we work with, like Ryder, they have, other models as well. And so of course everything gets vetted through our really smart people in data science and our AI committees.

But we’re agnostic on the governance side, I would say. If you prop pull the string too hard, it’s gonna break. So governance has to be thought of in a very, not in a one size fits all. Perspective. So globally, I’ll give you the example. If anybody’s worked with Asia Pacific, and I have done that at Citibank, and we have Japan business free, large Japan business at Prudential, Asia Pacific, Japan, they know what they’re doing.

They don’t want us to be telling them what to do or how to do it. So you have to tread really carefully and the governance model apply differently. So on global governance, we’ve chosen a model that [00:38:00] is customized. For every country. So if Japan doesn’t want champions, that’s okay. Everybody’s maturity level is also very different.

So when we first started, including our businesses into our compensation plan, if you go for the all or nothing approach, I don’t think we would’ve gotten too far. So when we started, we actually only included the US businesses and Brazil. ’cause that’s where we had the maturity. We had the NPS running for a few years.

Then we included PGM. Which is our asset management company, and then we included Japan. So there’s been a progression on that. It takes time and constant sort of, building the momentum with them.

Q+A (2): Yeah. All right. So first of all, that’s nice. Abhii, Carolyn, Judy amazing presentation. Thank you so much.

Two quick questions. The first was you talk about your business being a little complex in terms of end customer advisor, intermediary, et cetera. So how do you organize that in the org? And orient kind the prioritization of those different groups. ’cause they’re different stakeholders, especially like intermediary advisor.

You don’t own that, like that last mile. So I would love to kinda get your perspective on [00:39:00] that. And the second one was I think Abhii. As you, if you think about transformation, you’ve, I feel like you guys have cracked the knot on how do you get everyone in the organization really to believe in customer being important, especially some of those auxiliary groups like legal risk, privacy, that don’t interact every day with our customers.

So I’d love to get your perspective on how you did that as well. I.

Carolynn Smith: Yeah, very good question on the prioritization with the different customer segmentation. So while I’m US service operations, and I’ll use this as an example, we look to identify enterprise capabilities that can be agnostic to customer constituent and or channel or distribution.

That’s not a hundred percent of the time though, right? You have to respect the constituent nuances and the product nuances ’cause they’re real. When we think about prioritization and. Funding though it sits at the p and l level. So the business unit segments get their own allocation of investment to drive the business strategy.

We don’t have an enterprise strategy per se, around service. We have a service vision, but it ultimately [00:40:00] aligns to the business strategy. It’s a balance. It’s a little bit of our in science, but it’s a very important question because when we first organized the way that we did, we thought we’ll just build the one in scale from any, right?

We can make this investment and everybody can benefit. Our institutional businesses are very different than our retail businesses, and you have to understand when things can be scaled and not.

Abhii Parakh: Yeah, I would just add on that question. It’s about figuring out what makes the difference to the end customer who is ultimately paying the paycheck, right?

Initially, we thought that all efforts should be dedicated to that customer. But what we found over time, and this was probably not news to people who’ve been in the company for a very long time, but actually most of the feedback that we were getting, the positive feedback was based on whether the advisor had helped them have a good experience or not.

That made us shift our prioritization because it’s not, yes, you have to make sure that the customer has a good experience [00:41:00] and they have the basic capabilities when they come to us. Those have to be flawless, right? If they can’t log in. That’s bad, but the advisor is the one providing such a personalized experience to them that we have to make it easy for the advisor.

So there’s been an evolution in our journey on that. And then the second question on influencing all the stakeholders that is very tricky. I don’t know if we have cracked the nut, as you said. We have tried our best. Some of the things we’ve done is just give them examples of how indirectly.

Yeah, or directly they make an impact. Some of the highest ranking people in the company have said, whether you work with a customer directly or indirectly, you make an impact. So I think that messaging from top down makes a big impact. And second, we have given some real examples. You’ve all heard the the sweeper in the Disney Park, right?

Or the janitor in nasa and how they all feel like they’re tied to the mission. So it’s creating that kind of context for everybody. That I think helps as [00:42:00] well.

Judy Weader: We have one final question. Okay. Okay. We you have 18 seconds. Go for it. Lovely.

Q+A (3): It goes off of the most recent one you just answered.

I’m Christina, sorry, from Northbridge Insurance. I love your idea of the expo and all those fun things. We’re doing a lot of internal campaigns ourselves, but what do you do in regards to the customer obsession from an onboarding and getting those employees involved? What are you teaching from day one and what are you continuing to teach to those employees that maybe have been there for 20 years and hearing this for the first time?

So what are those little snippets that you are. Doing from an educational like learning and development department or so on? Yes. Yes. In regards to this type of learning.

Abhii Parakh: Absolutely. So we worked very closely with them. We actually launched during our second year of transformation and training one-on-one training, right?

Covered all the basics of what customer experiences overall, as well as what it means for Prudential. What are we trying to do? And we launched that. And to get traction in that training, we actually raffled Beyonce tickets. And through our brand partnership team. So again, love it all together, right towards this mission.

[00:43:00] So our brand team held out and we got to 4,000 people taking the training. And we announced the winners, but it kept going like it was just to get the momentum started. It is now the highest ever. Taken training in Prudential? Voluntary, not mandatory. Oh, thank you. We have about 12,000 people who have gone through that training, so that is just like the basic level training that everybody has gone through.

We also partner with them on onboarding. So we give that training as well as our leadership development programs internally. I was just at one of our executive leadership development programs talking about, what customer obsess and prudential means.

Carolynn Smith: Yeah, I think you hit it. That’s exactly it.

And then, Medallia a, a plug here, they have their metrics. So when you think about traditional service metrics, it’s not your al times that we’re looking at anymore. It’s the experience. Did you have first call resolution? How is your customer satisfaction? So leading indicators of customers likelihood to promote our brand, [00:44:00] become.

KPIs are key performance indicators in an operation.

Judy Weader: And if anybody wants to follow this example, Beyonce is on tour the summer doing Cowboy Carter. Go for it. Taylor Swift she needs to go back on tour. I need tickets. Abhii, Carolyn, thank you so much for your time. Thank you. Thanks, Judy.

This was a pleasure.

Q+A (2): Thank you. Thank you.