Appreciate it. All right. Welcome to Vegas. Thank you, mark. Thank you, Mark. And I’m excited to be here. I love Mark uses nicknames for a lot of us. He called me best of the best, but I was reminded last night when I was gambling that does not apply to the blackjack table. I only lost a couple hundred bucks, but I think of gambling as like innovation.

It’s important to succeed fast and fail faster. So hopefully I can learn from my experiences and do better tonight. And I have more time. So anyway I wanted to just give you a quick overview of really why we’re here and where we’re going. Mark has done a good job laying out how we got here from a business perspective and some of the priorities for innovation we’re looking at.

As he mentioned, my CX journey started back in the early two thousands when I was working with a company that was developing a lot of the unstructured and and omnichannel capabilities that drive [00:32:00] CX today. And after selling that company, spending a few years at another CX company, I came here to Medallia at the beginning of this year.

And a big reason why I came here is that as we’ve been watching the evolution of the technologies that support large language and understanding customers and understanding interactions at scale, it became clear that there is a renaissance coming in the CX space, a space that is going to be a.

Lit up by even more insights, more recommendations, more actionable capabilities with the platforms that all of us are using and have been using for the last few years. Medal has always been a CX leader, and I think right now we have an opportunity to really propel the CX solution space into a completely new generation of value creating capabilities.

We have here with our data and with the technology and with the teams that both you and we have developed over the years, I think a critical, massive capability to navigate pretty massive change over the next few years. And our goal is to work with you to make sure [00:33:00] that we make these CX teams and CX technologies more impactful, more proactive, and ultimately more essential in driving business success, business outcomes, and ultimately value back to the companies that we all work for.

To talk a little bit about how we got here, I’m gonna take, I’ll take a couple minutes to just define how each of these innovations have built on each other over the last 10, 15 years. Most of you, certainly myself included, started working on CX by bringing in and analyzing surveys. Surveys that came from solicited feedback first relationships, then touch points first, a few, then a lot.

And at the end of the day, a lot of that capability was used to first instrument and quantify essentially qualitative experiences through promotion and net promoter scores from CSAT scores. And from a wide variety of sort of impact analysis of how people score things and what they experience and what they talk about when they analyze.

Even in the early days, there was an important value to take the text of surveys and analyze it, to understand the root cause of a good [00:34:00] score or a bad score. And that capability drove disruptive change for a good chunk of the first five or 10 years of the CX world. But by 2015, we got to a point where most of the other actual interactions at scale were digital.

People were able to collect digital signals from websites. People were able to. Capture information from CRM systems that contained agent notes and most importantly, social media, which started out as a really, a tool for just promotion and branding became a place where people could talk about their experiences, where they could cry for help, and ultimately where they could actually be resolving issues working with companies.

And that data became even more important to understand because social information is public and a bad experience isn’t just between a company and a customer. It’s basically a public experience. So companies needed to tap into that, pulling together that data, using, again, to Mark’s point, a greater capability of natural language processing, sentiment, analytics, and some of the precursor AI technologies to what we’re seeing today.[00:35:00]

Made it more powerful and made it more impactful, and also allowed us to tap into and close the loop with customers in different areas. But a lot of that space was defined by siloed vendors social media engagement vendors, digital support and session vendors vendors in the contact center that were trying to understand what was happening.

By analyzing agent notes or agent interactions from CRM or recording platforms. And they were not built for always on, always analysis, always closing the loop interaction. So there was still a great growth. And during this time Medallia actually built and acquired a number of the technologies and folded them into the MEA Enterprise Cloud.

So Medal very much was at the forefront of multi-channel CX through the mid 2000 teens. In 2021 two things happened. The the world shut down for about two years with Covid. And most interactions that had traditionally happened face to face in a retail or a branch or a franchise location, were replaced with some weird combination of either hybrid experiences or [00:36:00] virtual experiences.

And I remember a study from the early 2021 period from McKinsey where they pointed out that most digital investments. That were made in 20 and 21, were triple the rate of the investments that have been made in the last few years. This was turning on e-commerce sites, turning on chat platforms basically creating hybrid experiences where you could start your journey with a company online and completed in person, typically at a drop off point.

Because even during that time, a lot of people weren’t going into stores or traveling or doing the kinds of things that you typically do when you’re not in a lockdown situation. And that investment created an explosion of additional sources, many of them conversational in nature. So it became important to tap into conversations.

The other thing, I remember several of the banks that I was working with at the time, they paused their surveys altogether. They knew they were gonna get negative scores. People don’t like having to be locked up at home and not being able to do business with people face to face. So it became even more essential to understand conversations at scale.

And at [00:37:00] this point, AI grew to another level of innovation where you were having to understand a conversation in stereo. You were having to understand the beginning. The middle, the end of a conversation and how each of those experiences form the basis of a larger journey. And try and understand what a customer said, how an agent responded, how an issue was resolved, or how it ultimately was not resolved and created additional experiences.

Now, when you combine all those conversation sources, you also created a compounding effect of the customer journey where somebody might start on one channel, hop to another, not get an issue resolved, call back later, and this was all one customer journey. So it became even more important if you’re a company to understand not just how did one touchpoint affect NPS, but ultimately how much is all of these conversational sources affecting the ultimate outcome of loyalty?

And more importantly, how effective are you when you’re throwing all these new technologies out to your customers? How effective are you at actually resolving issues? Are you actually making problems worse at the same time you’re trying to make them better? Because now a conversation [00:38:00] that might’ve taken five or 10 minutes in the store.

Is taking 30 to 40 minutes between a digital and a phone call and a chat, and maybe a chat on our IVR. And ultimately, you’re making conversations worse if you’re not continuously listening and improving from that. So there became a huge opportunity to try to create efficiency and a big lens on conversational analytics, which again, Medallia came to market with the Meti product.

Around this time, a big focus was trying to figure out how to make long calls shorter, how to make short calls more successful on the digital side. And also understanding how interactions at scale with agents to customers were either creating low risk positive outcomes or a high risk negative outcomes.

Because those can have a huge impact on ultimately whether that customer is gonna retain business, do business with you or move on. So now we’re at 2025 and what’s happening in 2025? We’ve had about two years, really, the end of 22, early 23 since chat, GPT and the large language model. Vendors have come to market, and these products are literally evolving at [00:39:00] light speed in their ability to understand, to predict, to summarize, and to recommend actions on a wide range of topics, including really all things customer experience.

They don’t necessarily know your business and your customers, but through creative engineering and integration of these core technologies with proprietary data in a secure environment, these things are becoming scarily good at being able to actually close the loop and support customer experience improvement in a continuous way.

We aren’t necessarily at a point where we’re gonna be using these technologies just to help improve customer experiences between customers and cust and the company in a human to human way. But increasingly, we may be in a world where, I was at one of the sessions yesterday and one of the speakers mentioned that what happens when my bot.

Calls a bot at a drug store like CVS and orders a prescription. Now there’s no humans involved at all. If the two bots don’t get along, they’ll [00:40:00] figure it out. How do I know how that experience is going? I can’t survey the bot. I suppose I could, but probably better off just understanding what the bot is doing and doing a digital analysis of that interaction.

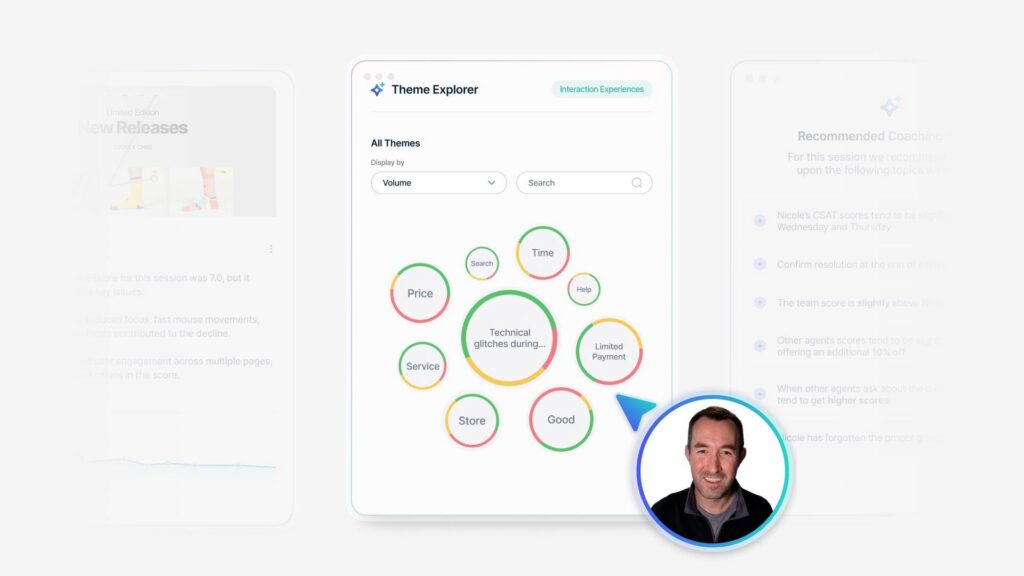

So we’re getting to a point now where CX can’t just be tracked by traditional techniques. We need to expand the aperture even further, and we need to use AI to understand the human interactions, to recommend human actions, to recommend machine actions, and ultimately to be continuously listen and improving to make sure that we’re not creating more problems as we try to create solutions with our customers.

So it’s important to have the data because all AI technologies, the best way to train a human or an AI to do the job, at least as well, if not better than a human, is to learn from the humans who’ve done it first. Medallia has the data, right? We have the conversation from your customers in your systems.

We can use that information to help you make your AI initiatives better. Because essentially humans will make machines better. And also machines, once they understand the human customer experience, can help coach and improve the [00:41:00] humans that are still out there doing that business. And actually often solving the more complicated, the more consultative, the more human intensive solutions.

So it’s essentially a virtuous cycle if we can make that innovation happen correctly. So at the end of the day, and Mark has mentioned over the last 30 days, he’s been talking to customers. He and I both have been really on the road a lot trying to learn from all of you, what are your needs, what are your pressure points?

What are your plans? And from a number of those conversations, a very consistent theme is emerging for me. And that is that we have learned that as people think about CX today, it’s not just about looking at data forming human insights in the human brain. And making decisions human to human, we have to be able to use everything that comes into these CX systems and actually make recommendations and even help you take action.

So we can’t be just an insights platform. We have to be an actioning platform, and that also means that we [00:42:00] need to think about the paradigm moving beyond. CX is a visualization through a dashboard. CX has to be operational, CX has to be always on. CX has to be interconnected to all the systems and processes that drive the customer experience.

And in order to be that platform, we need to rethink the innovation agenda for Medallia. We have to think about what does that look like in five years and work back. We have to future cast and then plan forward, and that’s essentially what we’ve been doing over the last few months. It’s a lot of what drives our thinking about where this world is going and where technology has to meet the human customer experience.

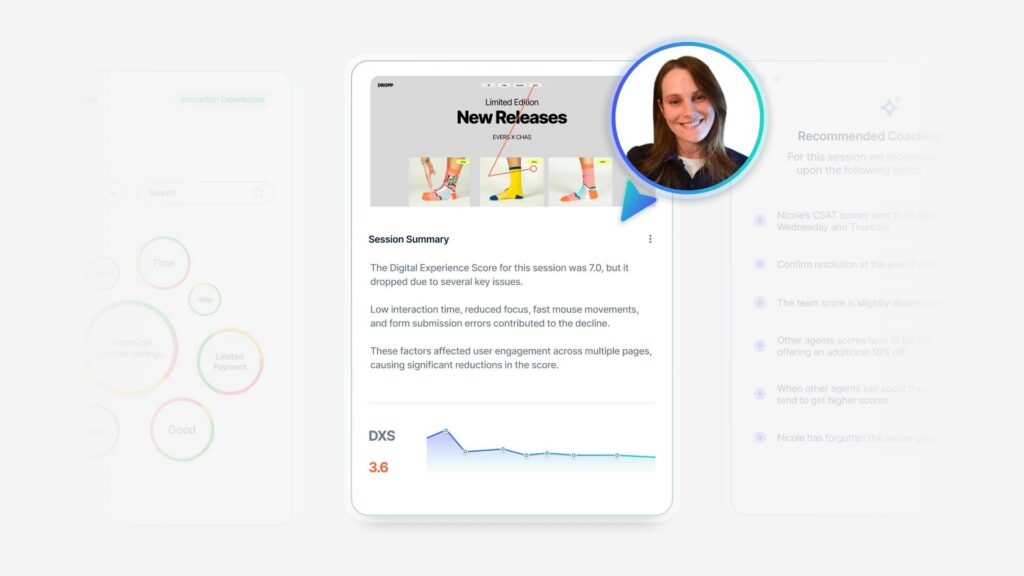

So let’s talk a little bit about three examples today we have been working on. So that’ll kinda give you an in informed view of where we’re going. So just to be very clear, this is customer cases that have been deployed at scale over the last five or six years. The first example is in the retail space.

We’ve been working with one of the large retailers for many years and they had started their CX programs, like many have with [00:43:00] traditional survey led touchpoint feedback, relationship feedback, market research work. When Covid hit, they actually hit a point where, like most retailers, they shut down their stores for about nine months and they quickly realized that customers still wanted to do business with them.

They had to really deploy their digital platforms and their e-commerce platforms for scale. And I had a lot of calls into their contact centers asking for. Can I pick up a product at the store or can I return a product that I don’t like at the store because I don’t have the ability to go into the store myself?

So they created a hybrid shopping experience very quickly that led to a whole bunch of feedback on what was working and what was not working through that re-engineering of the process. And they had a war room model where they continuously listened, continually trialed new approaches, continued listened again.

But they weren’t just listening to the surveys, they were listening to chats. They were listening to the conversations happening in the contact center. And ultimately that re-engineering allowed them to not just retain their [00:44:00] customers, but also to grow their customer base because they were one of the pioneers of creating this sort of adaptive shopping experience from 21 through 23.

And it today still is one of the leading examples of, innovation led transformation driven by a critical event, which was essentially a mass, mass epidemic, but it allowed them to grow the business and to actually retain customers at the same time they were able to make money. During a period of turbulence, another example in a different vertical.

This is the healthcare vertical. In the healthcare space, we find you can think of healthcare insurers and providers really supporting a wide range of customer journeys. In insurance, you have enrollment, you have servicing, you have claims processing, you have the pharmacy benefits division of the business, and each of those has their own opportunities for po forward and negative experiences.

Many of them are in the, what I would call the digital to care continuum online finding, ordering potentially fulfilling or changing plans or statuses, and then phone [00:45:00] calls and increasingly chats to handle anything that doesn’t work in the digital experience. And this company in particular saw its retail business skyrocketing.

In the few years after exchanges and Medicare plan plans became available to be provided by private companies. And those that growth in customer volume or member volume created a big growth also in cost that outpaced the growth in member volume. So they had a very keen objective to try to drive efficiency, getting more people to use digital effectively, getting more people to be resolved in the contact center effectively.

But again, surveys alone weren’t giving them the insights to be able to understand what was going wrong. So they built out a digital session and experience capabilities to understand where the digital journals went, stopped, where they weren’t getting resolved. And they built a set of contact center analytics to look deeply at when people call a contact center, how are they talking about their prior interactions with the company?

Before they [00:46:00] called, were they trying to do something online? Was there a digital fail? Was there something that happened that caused them to not get an answer to a question, the first call, and required them to call back? We also took a lens to understand what are driving the long calls. The long calls are the calls that often don’t get resolved because there’s an agent knowledge issue or a complexity or process issue, or just a customer unique situation.

And if we can see how many of those interactions are happening across many customers, that adds up to a lot of costs and a lot of inefficiency. And I don’t know about you, but how many of you like to spend 30 to 60 minutes on a phone call trying to resolve a customer support issue? Yeah, it’s a negative customer experience too.

So it’s important to take a look at calls and say, what makes a long call long? How can I make it shorter? What makes a short call short? And can I fix the digital experience so that people can do what they need to do online or in an app? And that was the analytics we built together with this customer.

And over the first three or four years of working with them, we took out literally single [00:47:00] digit, in some cases, double digit expenses from their customer service experience and their claims experience. And their enrollment experience and ultimately also improved customer satisfaction in NPS. But you don’t do it by obsessively analyzing on the surveys.

Surveys are a lagging indicator. It’s just like you don’t grow your stock price by focusing on stock price. You grow your stock price by growing your business, by having good financial performance. And ultimately the lagging indicator is the stock price. This is the same with NPS and with surveys. You have to focus on what causes that survey to be a certain score.

And this is where going deep into conversations really makes a difference. And in this case helps you save a ton of money over many years. So the third example I’ll mention is in the financial services space. And this is a company that we started working with about seven years ago. And they came to us because they had a bit of a financial imperative.

They were working with a regulator. I’m not gonna obviously say who these companies are ’cause they’re not always [00:48:00] positive references for the companies, but they’re positive outcomes, which is important. They had a financial imperative, which was a regulator had identified that they had been offering a particular insurance product to their credit card customers.

But the problem was the customers didn’t know that they were being signed up. This was a service fail that produced a regulatory fail, which produced a consent order that required the bank to quickly identify any customer that had ever complained about not signing up for this product and proactively communicating with them and unloading the product and giving them a refund for anything that they’d been charged up until that point, and they had basically 120 days to do it.

That required us to go deep into all the contact center transcripts for the last year and look for occurrences of that particular type of complaint. It was a regulatory complaint. We surfaced the customers, they proactively reached out to those customers. They remediated the issue through a closed loop mechanism.

And by the way, while we were doing this, we found a lot of [00:49:00] opportunities to look for service fails and digital opportunities for improvement. But the initial lens that we shined on this data was how do we reduce risk? And reducing risk also improves the customer experience, improves customer loyalty, and ultimately keeps you outta trouble with the regulators too.

These are all examples of how you can use conversational data to drive high value in your businesses today and improve customer experience. So let’s talk about the future for just a few seconds before I introduce Fabrice. All of that conversational data, all of that digital data, all of that feedback data is now the fuel that is going to drive the next wave of in, of, in innovation for all of us.

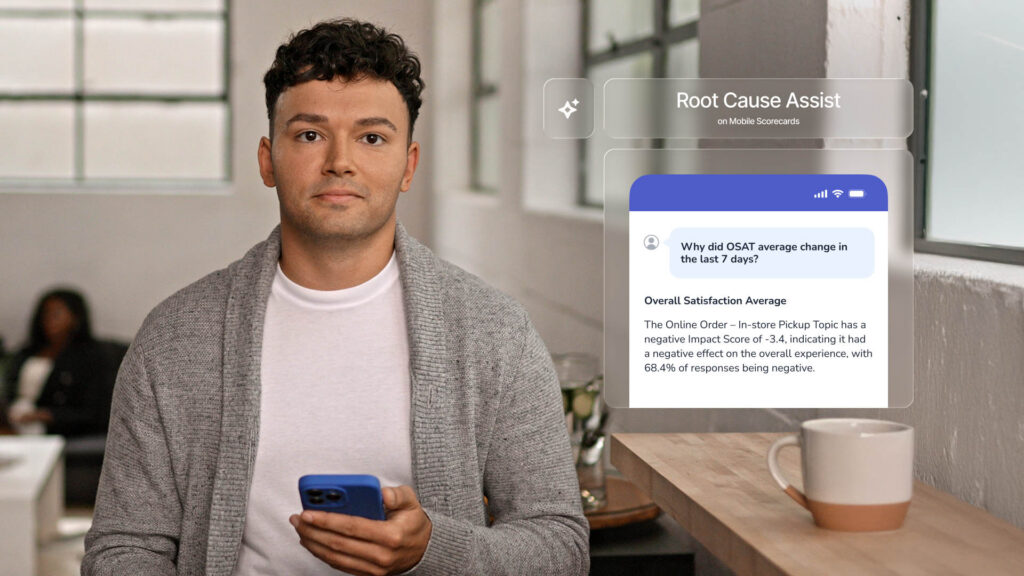

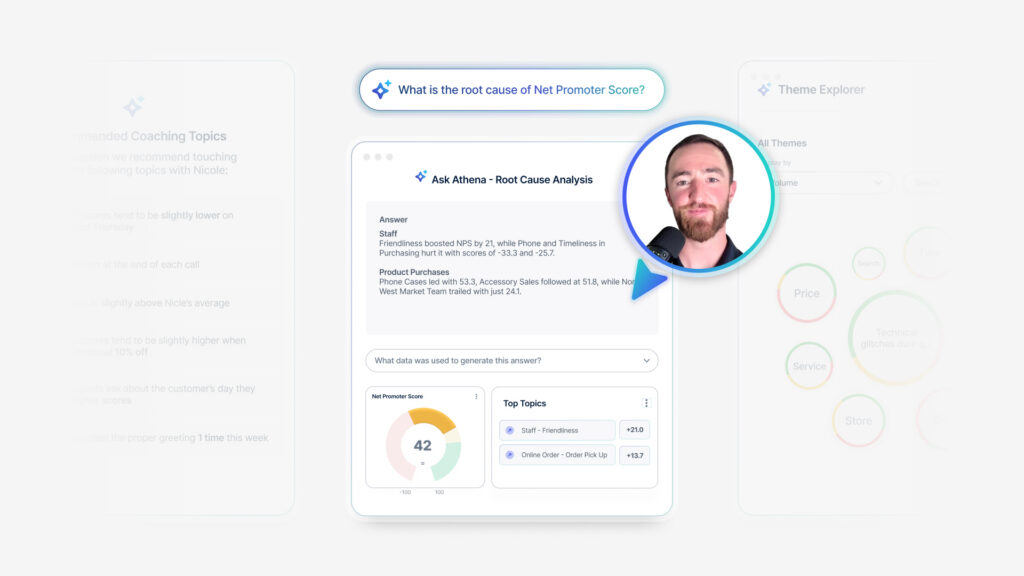

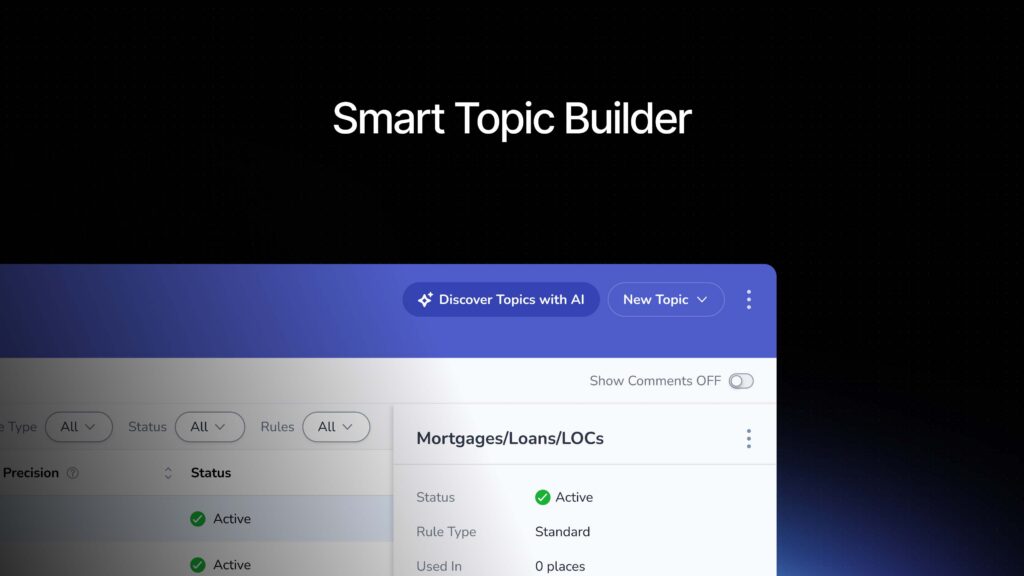

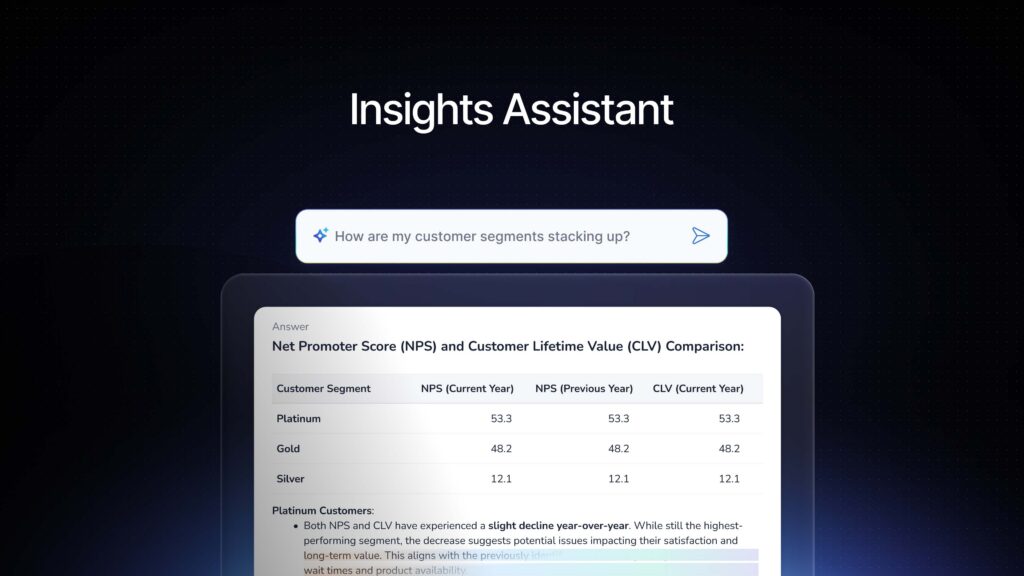

And there’s really three ways to think about when you apply ai. How do you use it to continue to drive that value equation? Drive more ROI. Better outcomes, better savings, better loyalty. Less risk. The first is, and I’m sure most of you have [00:50:00] probably played with chat, GPT AI is very good at analyzing a lot of data.

Throw it into the system. Say, find me something specifically. Find me good outcomes. I want to magnify negative outcomes. I want to fix performance issues. I want to try to identify so I can basically coach my employees or change my products or tune my marketing campaigns. Analyze is the first step. It helps you find things that you want to then drill deeper into and try to fix, and that is going to be what you’ll see from Fabrice in just a second.

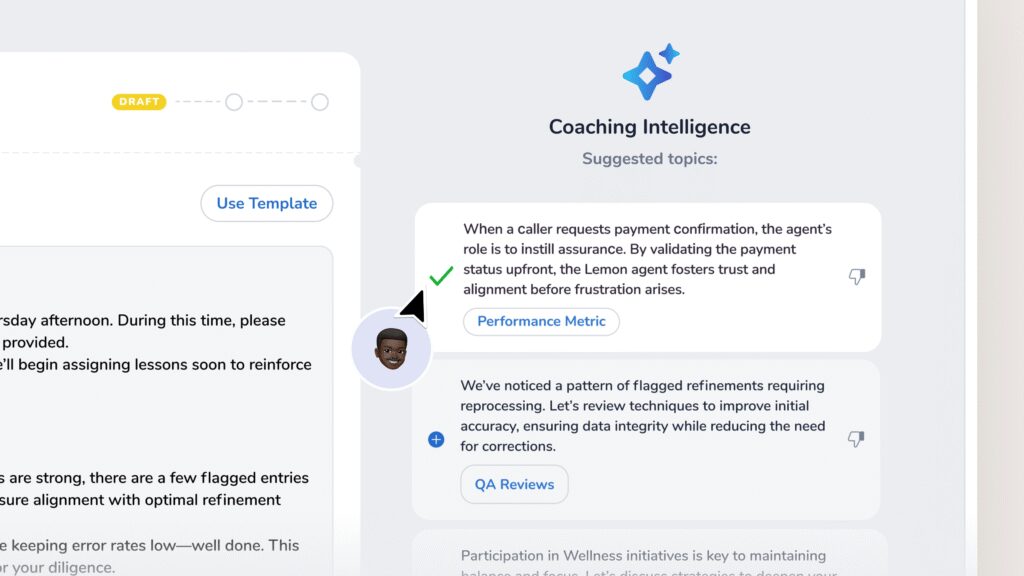

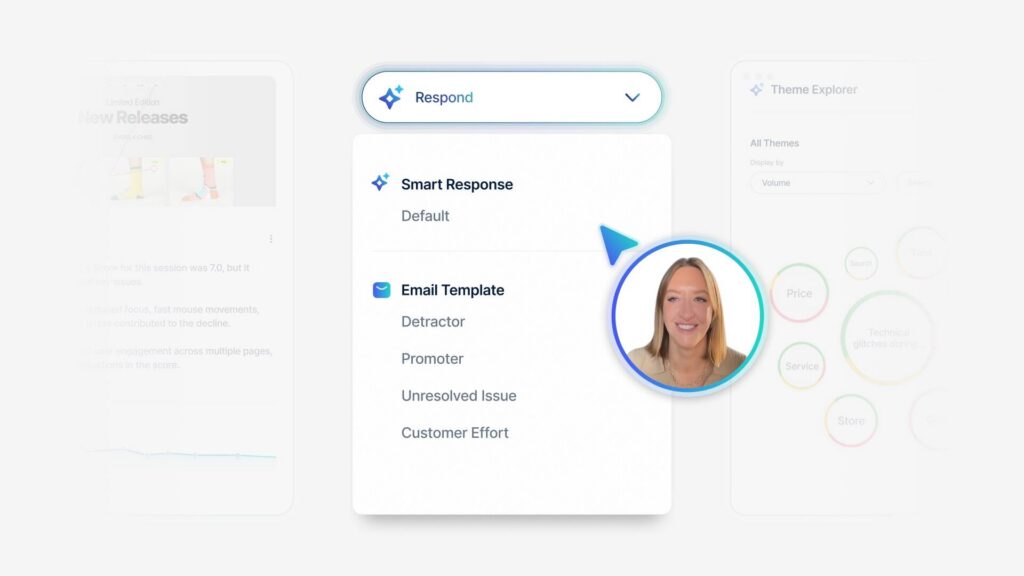

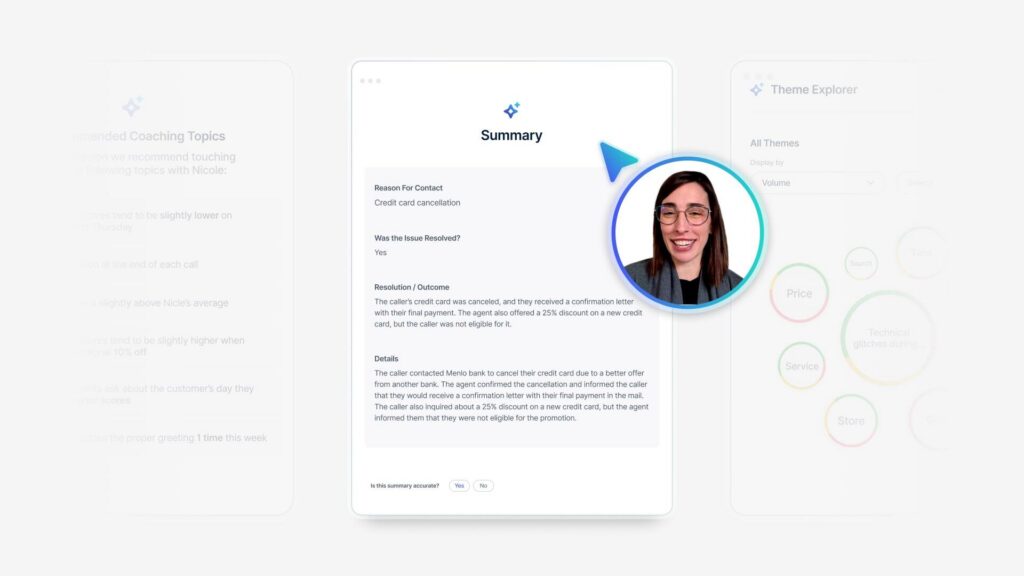

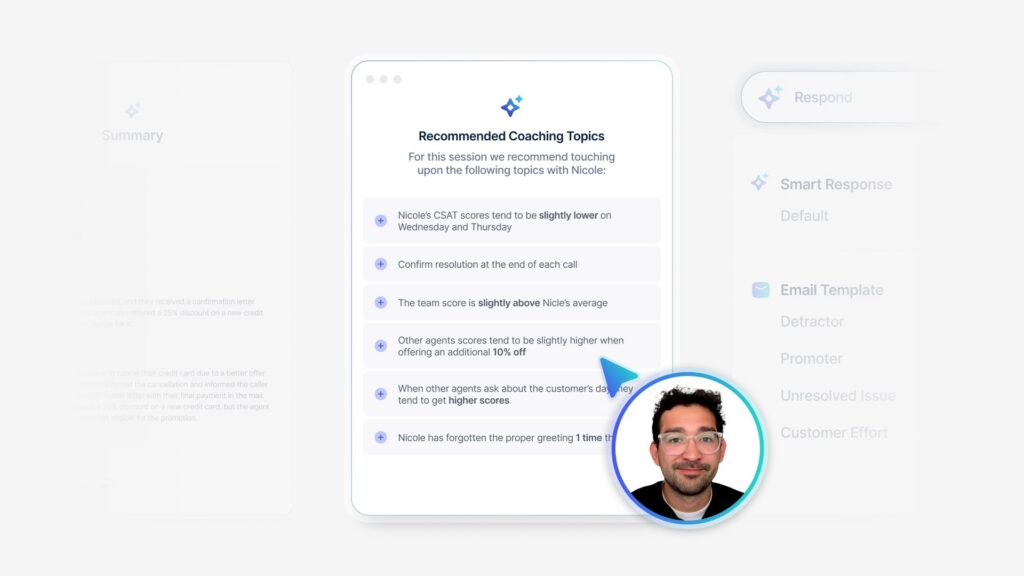

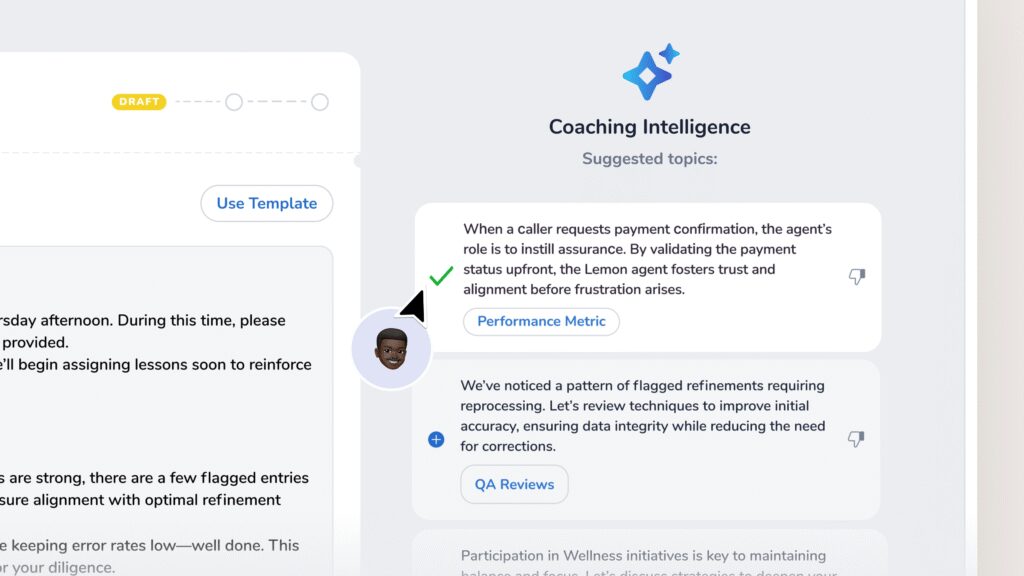

The analysis has been turbocharged through this current generation of ai. The second and even more powerful way to use AI in this current era of large language-based AI is to actually have the AI proactively assist and create the response mechanism. Or action that needs to be taken so that a human, particularly for some of the high scale interactions, can be [00:51:00] coached to get better based on how they’re performing on a call, by call or chat, by chat or a service or service experience.

And even when you’re a customer, providing the messaging that you want to deliver to that customer through a smart, intelligent, recommended response. So instead of you having to think about how do I create the perfect answer, how do I show empathy? How do I define things? Let the agent, let the chat bot, let the AI suggest an approach.

Look at it, tune it if you need to. But in many cases, it’s as good as what a human might write many times, and that gives you more time to focus on the higher value, harder things. Let the AI do the things that it can do well. The third area, and both of these by the way, we’re going to be announcing today and are going to be available, and we encourage you to co check out these features in the display area next door, the third area, which is really where we’re going.

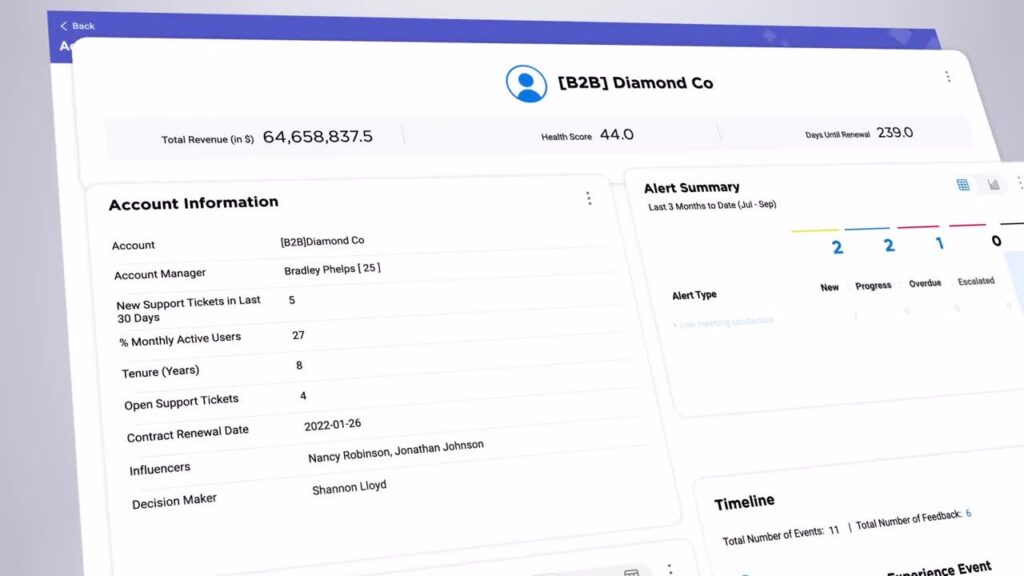

Is to use AI to be agentic, and now it’s an overused term. Agentic AI doesn’t mean agent like a call center agent. Agentic [00:52:00] AI means the AI takes agency, it does things, it can close the loop, it can connect to a CRM system. It can change a customer status. In a marketing cloud, it can proactively order something for you if you can’t do it yourself, right?

AI that can understand the customer experience at scale and suggest an action which it’s doing in that second column in the not too distant future will actually be able to take action. And when it does that, we become an agent for our customers to help them have better experiences. We also become an agent for our employees to help them focus on the things that fall outside the realm of ease or doability by the ai.

And that allows us to continue to improve, solve the hard problems, innovate the things that we can’t train a machine to do because. There’s no data for it. The human brain is still gonna be that last mile of innovation for most of the things that go beyond what an AI can learn because it hasn’t learned it yet.

And when we have that [00:53:00] capability, you’re dealing with a new, truly 20th century, 21st century AI market and AI capability for everybody. All right, so I have the easy job. I can just talk about this stuff. I’m blue skying like crazy. Fabrice has the harder job because he actually has to deliver this with our technology teams.

So what I’d like to do next is introduce and please welcome my partner in crime, Fabrice Martin, chief Product Officer. I’ve known him for over 30 years. He’s one of the, what did Mark call us? Best of the best. He’s the best of the best when it comes to product innovation and I am happy to see him.

Fabrice, welcome.