Wendy Lustig: [00:00:00] Everybody, welcome to Thriving Experience Ecosystems begin in the contact center. I am Wendy Lustig, director for quality and experience for Advent Health. So I handle our agent quality monitoring and then also our post-call survey space.

Tim Frazee: Yeah, and good morning everybody. My name’s Tim Frazee, so our lead, our contact centers, so have strategy over them as well as Teleny for as a whole over Advent Health.

And we just want to give you guys kind of some level settings. Some things we really want you to think about from a key session, thought process is, a lot of times when you come into these sessions, it’s maybe not what you expected to hear or what you wanna hear, but, so we wanna be very transparent with what these are.

The things that we’re gonna kind of talk about today, we touch points, is we really wanna talk about scaling the consumer’s experience, the demonstrating the value to the business, and then really what are some of the lessons learned, some of the overcoming challenges that we’ve faced over the last couple years.

With all our implementations into the contact center settings. So who is Advent Health? Really, we’re a healthcare organization that was founded back in 1973. We span across 10 different states. We have 55 [00:01:00] hospitals. We have a hundred thousand employees. From a net revenue perspective, it’s over $20 billion.

So very large healthcare system. And Advent Health has a vision for 2030, so. Just quickly, we wanna be known for being a preeminent, faith-based, clinically cared, consumer-focused organization. And what I wanna talk about today is just to give you guys an understanding of what are the consumer experience centers.

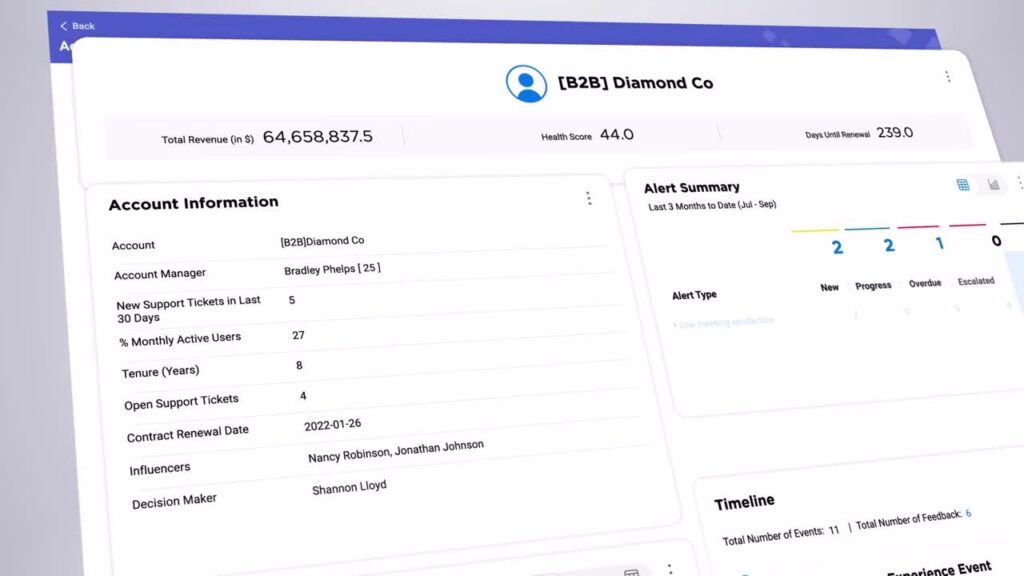

So this is where the contact center actually sits inside of Advent Health. We use a very significant tech stack across the board. So you can see things like five nine being our CA platform. We use Variant for quality management. We have Epic, Medallia, Salesforce, all kinds of training tools like Kahoot and Articulate and Office and Wrike to help us bring those agents up to speed.

At one point in time in Advent Health, we really thought about could we come into it with one channel, one main contact center line of business, regardless of the market. And we quickly realized that our consumers have different behavior patterns based on where they live, whether that’s in [00:02:00] Chicago or Texas, or Tampa or Colorado.

They’re all gonna react and respond differently. So around 2021. We change the structure to a hub and spoke model. So from a contact center standpoint, we keep consistency along across things like training quality insurance, the voice of the consumer workforce management. We make sure that those things are standardized regardless of where the market is.

But then we have operational leaders that support those independent contact centers across all those different markets and run your day-to-day functions with the support. Of the corporate team helping them keep a standardized approach on those specific, uh, components. You know, one of the things I think is, is interesting and I’ve heard in, in different seminars and including here, is back in 2021 when we changed that structure, our chief brand officer was really the individual that’s responsible for the contact centers.

And I think a lot of folks are transitioning in that model today. But this has been our model [00:03:00] for the last four or five years. So very governance space. Again, it’s driven by the market directors and and downwards where we have really. A scaffolding approach of how we support them in those individual markets.

Wendy Lustig: And when we look at the markets, you can also see that we have a, a mix of remote and hybrid. So for those of you in that contact center space, you’re going, Hey, advent Health, you have eight different markets. Where is everybody? Where do they sit? Do you have offices in every market? We do, but there is a great combination of both remote work and hybrid work in this space.

We also have a lot of cross-trained team members so that they can help in different functionalities. So our, our contact centers support. Scheduling. They support marketing outreach. They would support referrals. Um, and so we also cross train our, our team members so that if, you know, one line of business is a little bit slower, we can help them in another, which I’m sure many of you do in your contact center spaces.

I. Regardless of your, your industry. So we follow a lot of that model too. Yeah.

Tim Frazee: And we’ll talk to you guys a little bit about this more later, but you know, that front door is really large. So we’re talking, you know, 20 to 25 million calls that are coming into the system today. 7,000 team [00:04:00] members. We use our CCA platform regardless of where you’re actually connecting from a consumer standpoint, whether that’s at a physician practice in the contact center, all those folks are using the same technology.

So I’m gonna let Wendy talk about this for a moment. You heard me talk about, you know, healthcare. Has many front doors into its system. The contact center is your largest front door.

Wendy Lustig: Yeah. So we just talked about just kind of our structure, right? And when we think about healthcare, those of you that are in healthcare, what’s the first thing you think about patient experience?

Right? That we go really heavy in that space. And I think for our organization to mention that we fall under the chief brand Officer. So for Advent Health, we’ve really had a focus on. There’s more to that experience than just the patient experience. When you think about how many times the outreach is happening from a chat perspective, a call perspective, they’re making a lot of contact with our brand.

But before 2021, we weren’t getting that feedback ’cause we were only focused on that patient experience format of it. So for the, those of you in that space, or if you’re not familiar with healthcare, [00:05:00] your patient experience is what happened when I was in my doctor’s office. What happened after I went to a hospital?

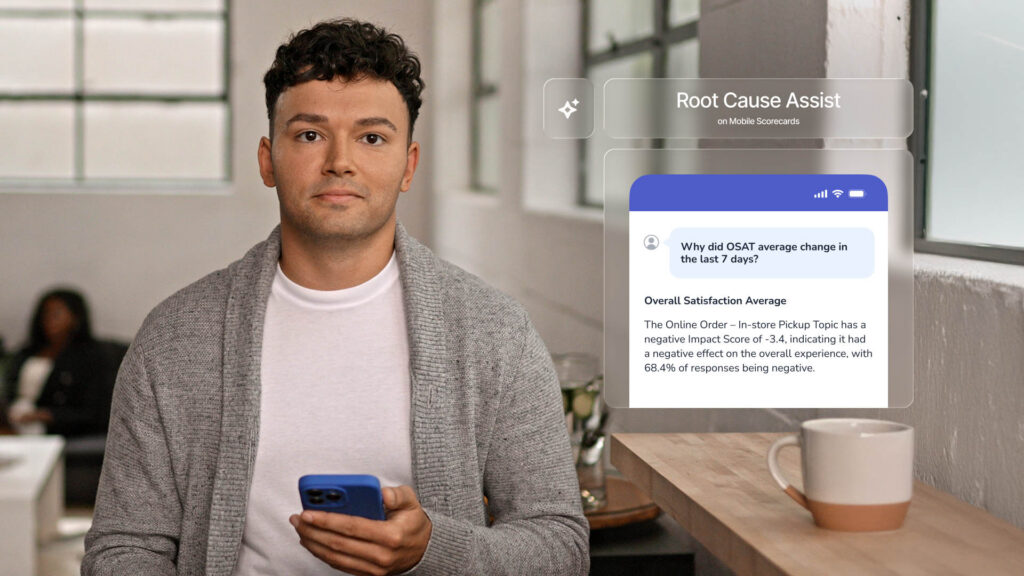

You’ve had that inpatient care experience. Um, so many times they’re not telling you feedback about, gosh, it was really hard to get through your phone system. There were too many prompts, there was, there was too much navigation. So us bringing in the voice of the consumer now gives us access. To, to over 20 million calls a year to receive feedback on in our system.

Tim Frazee: You guys touched on it, and if you guys work in that healthcare space, you know that stuff is typically coming in from a press GA type of funnel, right? So a lot of times the feedback that was coming in was 3, 4, 5, 6 months posts. Right. So really hard to be agile in that space and make changes on the fly.

Wendy Lustig: All of us in here have stood up a survey, you know, everybody loves it. The minute that you turn it on, they jump in both feet. They’re like, yeah, surveys, right? No, not at all. Right? You gotta kind of, you gotta kind of prime the pump. Um, you gotta get them some acceptance into it, right? So as we’re talking about this.

We talked about our consumer [00:06:00] experience centers and in our contact center space, right? That’s where this survey is. Yes. Advent Health has, has surveys in other places, but this is really around how we got this growing, not going, growing in our contact center space. It wasn’t easy when we first got started.

Some leaders didn’t understand why, what’s going on, so on and so forth. But as Tim mentioned, with our organizational structure, we report up to the chief brand officer, our chief marketing officer, um, and where that helps us. Is we are very focused on that consumer and patient experience. So on the screen you have what our consumer win categories are, and we have part of our listening engine team here too.

And they, they also bring in insights that we tie to this. So when we are trying to make a point with whether it’s our leaders in our market, whether it’s our executives, whether it’s our C-suite. Our ability to tie the feedback back to these consumer win categories is what drives that engagement for us.

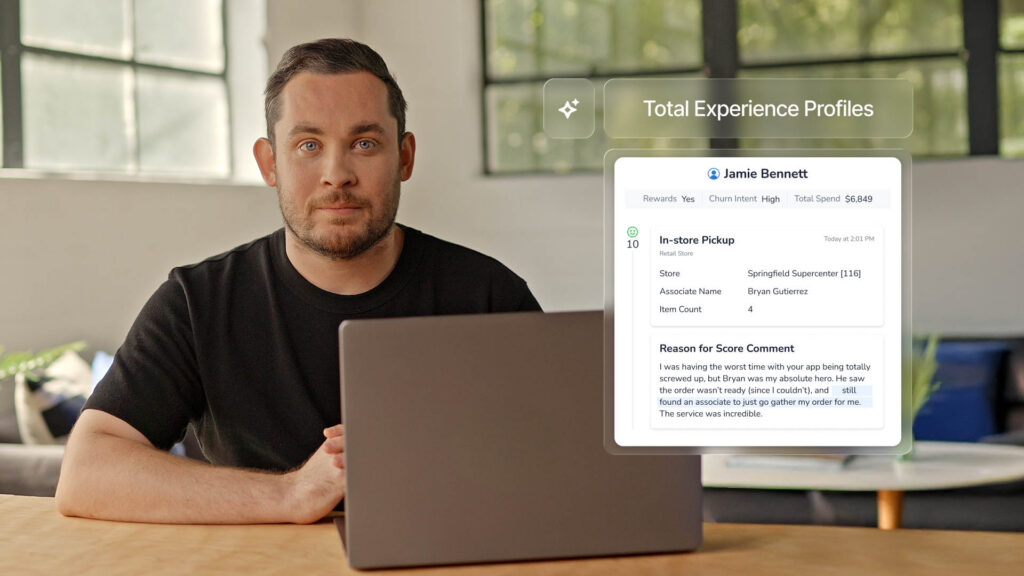

That’s what drives at home. That’s what helps them go, okay, yes, this feedback makes sense. [00:07:00] This is worthwhile. Ultimately, what we’re trying to do, like many of us. In here, whether you’re, it doesn’t matter what your brand is, you’re, you’re trying to acquire new customers, right? You’re trying to keep the ones that you have loyal and engaged with your brand, and then you just wanna keep ’em all together.

So even if they aren’t loyal and engaged, don’t want ’em to go somewhere else. You want to want to keep them. So for us, and we’ll talk about this in a little bit too, when we talk about value to the business, but when you all are thinking about. Hey, how do I get this going in my contact center, especially if I’m in healthcare?

’cause everybody’s kind of tied to these 75 percentile and, and everything else that you might get outta patient experience. Our ability to tie it back to, um, behaviors and outcomes. I’m not saying ROI is an important dollars and cents, makes the world go round, right? But this is another value to the business that, that you can demonstrate and we’ll talk about that.

We’ll elaborate on that in just a minute. Okay, so we are at a survey, well, not anymore, according to what Mark said, we’re at a, at an insights convention. Right. But I know the people in this room, you set up your survey. So let’s talk about our post-call survey a little bit. So. It doesn’t [00:08:00] matter where you call Advent Health.

When you get our post-call survey, it’s the same. What that allows us to do is some of you might be going, wait a second, you don’t ask flex questions. Wait a second. You don’t customize this to your scheduling? No, we don’t. It’s literally four questions that we ask after everyone, whether you’re in a consumer experience center, whether you’re rev cycle, whether you’re with our payment post or pre, things like that.

It’s all the same. So one thing that we have is we have to have our customers or our consumers opt into the survey. That’s our legal team. But that’s one step that we have to go through. We have four questions on the survey. One is the likelihood to recommend this will be changing soon to a loyalty question.

We have oat, which is for the agent that they spoke with. We call it first interaction resolution. That’s first call resolution. It’s, it’s the same metric we just call a different acronym, and then we have drivers that, again, tie back to service standards that we have in our organization. So while we don’t publicly say these are our service standards, ’cause those are for our employees, we do ask our consumers like, Hey, how well did.

Wendy hit the mark on, on meeting some of these drivers.

Tim Frazee: Now, I would just add the, the reason behind the [00:09:00] FIR kind of perspective or, or call out rather than the FCR, which is traditional in the contact center space, is because we’re, it’s activated inside of our chat platforms as well, right? So when folks are actually chatting, we wanna make sure that they’re having that same type of resolver interaction, whether they’re.

Booking a physician appointment through a chat service or just inquiring about a med refill or something along those lines.

Wendy Lustig: And I was telling you a little bit about this earlier, but it’s, it’s in our physician enterprise. So that’s your primary care net doctors that you’re making appointments with revenue cycle.

So that’s pre-stay, post-visit, payment collection, or ahead of time. Our population health. Space also in our pharmacy for specialty or regular medications. And then also our consumer experience centers. We’re, again, we do everything from, well, you saw it on the hub and spoke model. There’s quite a quite a list of things that we do in that space as well.

This is also the very first post call survey for many of the leaders in the organization, because again, traditionally healthcare, their focus. On patient experience and getting feedback from that space. So one of the growing pains, uh, for us, which we’ll talk about a little bit later too, is just, it’s, it’s new for some people.

So they don’t understand the why, because it’s a new metric. It’s a [00:10:00] new way of looking at feedback. Nobody will say no to receiving feedback, but that was an education point for us too. Alright, so let’s talk about how to scale. So, when we first started this, we piloted it in our, our Consumer Experience Center for Central Florida, which, and a couple other markets, but you’re talking about 2000 seats.

I think we’re up to about seven now. But what this allowed us to do was actually get. Voice of the consumer feedback. How many of you have been a contact center operator before and you don’t have that feedback and you are just throwing darts in the dark hoping that you find what’s the problem or what’s the pain point that’s making your consumers, or in this case, your patients?

I. Feeling a certain way. So the nice thing is with this feedback, it allowed us to make data-driven decisions. Not that your gut’s a bad thing, but you know, that can only take you so far in business. So the anecdotal thinking, it allowed us to kind of vacate that. We also, as we grew this, you all know your consumers just don’t answer the question that you want on that survey.

In our case, if they called us in the, in the contact center, but they had a problem with a parking lot at one of our [00:11:00] hospitals, we’re gonna hear about it, right? I don’t have anything to do with, with parking lots. Right? But that’s where they’re gonna let that, that feedback happen, which is great. But what that allowed us to do is just observe where those pressure points were.

And I’ll get to this on a, on another slide, but that also helped us to strategically align of how do we grow this. Right. So in your businesses too, when you think about, gosh, they’re always talking about, let’s just pick on the check-in process. And if everybody’s talking about that, then maybe I need to go figure out why am I clipboarding them to death as they come in and having ’em fill it out on an app and then a paper when they get on the inside, and then I gotta fill out something else.

It, it just helps you to go, okay, this is maybe where we need to make some changes, but then also solicit feedback. What do you think is a faster check-in process?

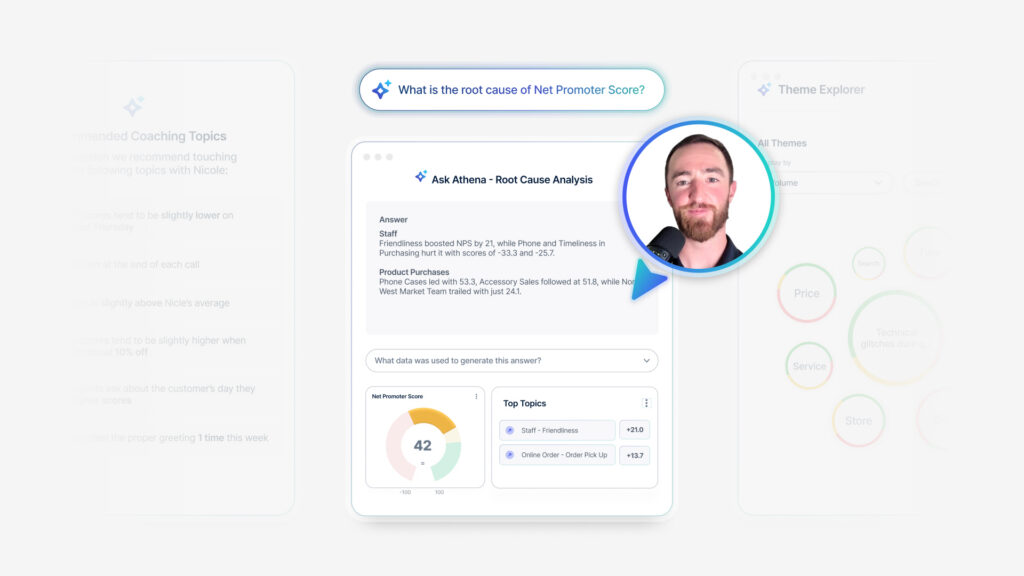

Tim Frazee: The only thing I would also add to Wendy’s point guys, is I know we’re here, we’re talking a little bit about surveys this morning, but from a contact center lens, that’s just like the tip of the iceberg, right?

So we’ve already dabbled our toes in AI summarization. We’re using speech analytics, we’re using text analytics. We’re listening to phone calls from that perspective, and we’re trying to hone in on those key friction points in [00:12:00] conjunction with the survey to help tell that whole consumer story and journey path

Wendy Lustig: by observing and by engaging those other lines of businesses that we’re being talked about.

And receiving feedback that they really had no clue they were getting, ’cause they didn’t have a post-call survey before that allowed us to drive engagement and increase buy-in for those to go, Hey, yeah, this post-call survey is important. And then you know how it goes. The kinda storm gets a little bit bigger and bigger and bigger and all of a sudden you have a lot of people that are behind it to say, Hey, this is something worthwhile.

I want this in my line of business. I want this feedback. I want to be able to get insights that help me. To make changes in my business or even to quantify changes in our business. I think a lot of us, as a contact center leader, you have a pretty good feeling about what’s happening, right? That’s an analytical thank you, but you can’t quantify it.

So as soon as you can quantify it, you’re like, all right, now I got some numbers. Now I got some proof in the pudding that I can take back and try to influence people to buy into what we have. I called out our listening engine team a little bit earlier, but one of the cool things with our post-call survey as well is we take this data and we.

We dump it into our listening engine. [00:13:00] Our listening engine, and for lack of a better term, is just our omnichannel journey mapping source that goes, okay, we’re taking in data from all over Presca, as Tim mentioned, the post-call survey. We have digital surveys, we have chat surveys. I know I’m missing some in here, but that allows us to help journey map where those people are coming from and, and how they’re accessing Advent Health, at what point in the system or channel that they’re coming to us through.

And that just helps, again, build that strength for the product that you’re putting out there to make your business better. This is actually, I don’t wanna say pretty recent, but this first interaction, alert, maturity. So it doesn’t matter if it’s a survey or your other insights that you’re trying to get, you’re all trying to drive actionable action, right?

Like you’re trying to get insights that are actionable that can make you do something to go change. I. Something. One of the things that we’ve recently been working on is our, our first interaction resolution alert. And this is just our maturity of it. So like everybody, this story isn’t unique to us.

Everybody is going through this. You first kind of start your closed loop, you’re kinda like, well, I’m not quite sure what to put on here, but let’s, let’s take a pretty good shot at it, right? And then as you go through, you’re like, Nope, that doesn’t work. [00:14:00] That’s not getting the data that I need it to do.

That’s not capturing the actions that leaders are taking. So when we first started, we stood up in 21. We got this going at the beginning of 2022. ’cause obviously we need a little time for people to get used to. A new platform, but throughout 23 and 24, we had a lot of growth in our organization for the post-call survey.

I mean, when we initially got going, it was about 500, 700, and then we got into the 2000 space when we got all the contact centers on. Now we have over 7,000 users, so we’ve grown a lot in the past few years. Yeah, and

Tim Frazee: just taking you guys back to that original comment that I made, remember that Advent Health was on one journey where everything was funneled into one place.

That was that 21, 22 time period. So here we are, 22. We’ve now created a decentralized model with that hub and spoke model. And now we’re really thinking about what insights and feedback and themes and topics are we getting from this market, this market, this market. Where are they the same? Where are they different?

How do we tailor our approach in those specific areas?

Wendy Lustig: And I think we’re really started to notice pretty heavily. Um, in the start of 2024, it was [00:15:00] kind of that garbage in, garbage out. Like your data just isn’t good because you’re. In this case, our closed loop form didn’t really match what actions our leaders were taking.

So lemme pause on this slide for just a second and, and kind of high level talk about our closed loop form. When we have an alert, here’s what I want to know, what was the real problem? So we, we ask you, did you listen to the call? I hope you say yes, but did you listen to the call? What really happened? And then what did you as a leader do about it?

And so when you think about that, it’s root cause and then leader actions are the, are the two main buckets in our, in our closed loop form. So when we’re talking about these growing pains, a lot of the options in those dropdowns didn’t match what leaders were doing. And so naturally, what are they going to do other.

Other. Other. Okay. Well that doesn’t help me when I now have. You know, 7,000 users that are potentially putting this in there. And I go and I pull my responses and, and I’m not making this number up. We did this at the, probably like third quarter of last year, and 60% of my responses are other what? Useless data.

Like we’re all sitting here going, cool, you filled out the form. Good job. But I [00:16:00] can’t do anything with it to action it at a higher level for my executive to say, this is where the pain point is. So where we took, this was at the end of last year, we had the world’s. Largest work group. There’s like 65 people in it, which you’ve ever had a work group.

It’s probably giving you PTSD from college. But what that allows us to do with that size though is have representation from every line of business. So on that previous screen where I said where it was physician enterprise, consumer experience centers in our pharmacy, in our revenue cycle, leaders from all of those lines of businesses were there to say, this is the workflow that my team should happen.

And the cool thing was, I’ll, I’ll use Tim as an example, ’cause you’ve been with Advent Health for 25 years and you’ve done a lot of different things. Even if Tim wasn’t in that space, he could be like, I don’t think that’s how rev cycle is that really what you did in rev cycle? I thought this was the process.

So it was really cool in that work group to see the systems of checks and balances to make sure that once we came out with these options. That leaders had things that they could pick and we kept them away from other. The other thing that we did with 2025 this year, and I’m, I’m actually, when I get back next week, I have one last session, I think I’ve done 11 of them this month.

I walked them through these updates. ’cause [00:17:00] this goes live, this new one goes live first on April 1st. But we have guiding principles and I, I think I’ve. I saw this somewhere yesterday in one of the mug sessions, but it’s basically saying, Hey, here’s kind of our guardrails, right? So if you think about a road and you’ve got a guardrails, I mean, listen, there’s kind of rules.

Stay in your own lane, observe the speed limit. But as long as you’re in those guardrails, for the most part, you’re pretty much safe. But this was just saying, Hey, these are the things that we wanna do. We want you to close out these alerts, you know, 75% of them within the first 72 hours. We want you to make sure that.

Other is represented less than 10% of the time in your selections. We wanna make sure that if you do have to call a consumer or patient, that you do it at least three times before you close out the alert. So we kind of set those ground rules. So hopefully as we come back and, and next year, I would hope when we share some data with it, we can say we are really confident in this.

So that when our analysts at the corporate level, or in those higher seats at the market level, look at that data, they can trust what’s there and, and they can see this so. This first interaction resolution, just thinking about alert maturity. It’s not alert growth. I mean, growth is just adding more people on, which we’ve done.

The maturity is saying, Hey, what we had didn’t work. We need to kind of [00:18:00] tear it down to the studs and rebuild it to make it work for where we currently are. And then we’ll also have a process for new suggestions that come forward in the next couple months. This just popped up, but you talked about this a little bit too, is just Advent Health is, we’re very governance based.

We get questions about what’s the governance of your, your program, and, and I intuitively we’re, that’s just kind of the way our organization is set up.

Tim Frazee: Yeah. I, I think we’re gonna get into that in a minute. Yeah. But I can, I can jump ahead. So when we talk about governance space, it’s very. Committee driven, we’ll use an example.

So we have an Advent Health telephony committee, right? And in that committee, those individuals that participate in that are executive directors and up traditionally, and they’re making business decisions for the organization as a whole. From a recommendation standpoint. How should we approach our surveys?

How should we focus on FIR? How do we fix abandonment rate? How do we use AI summarization? Where do we put it? Is it better to put it on our nurse clinical lines? Those conversations are happening in that space. From there, those go up through consumer leadership channels where our SVPs and EVPs are making decisions based on the [00:19:00] recommendation from these individuals that are coming and are boots on the ground operators in that space, and they’re taking that feedback and that guidance from the folks that are doing it day in and day out to make their executive decisions on how do we move the needle?

What technology do we need to purchase? Where do we implement first? Where do we pilot? How do we move the needle? From the organizational standpoint, as you heard me say in 2030, advent Health’s goal is to be preeminent faith-based, consumer-focused clinical care network, right? So we have to start listening to what our patients and consumers are telling us.

From the very beginning, and that’s not just in the survey, that’s in various different channels. And this group of governance helps us kind of orchestrate that.

Wendy Lustig: Yeah, and I think what’s cool about Advent Health is, um, we really go towards that. Like there’s some organizations where you probably sit in here going, God, I really wish my company did that.

Right? And it’s like, oh, I, I pulling teeth. We’re very siloed. It’s not to say we don’t have silos. People, we do have our various lines of businesses in our regions and you know, people own those things, but there is just a. It’s [00:20:00] very intentional, um, to make sure that we, we have that support and that alignment and that kind of committee structure that’s there.

Just real quick, coming back to this closed loop format, and then we’ll talk about how to scale is just as I mentioned with the post-call survey, everybody uses the same closed loop form. I don’t care what line of business you’re in, it doesn’t matter. I think the cool thing is, is that allows us to capture data across the organization and you’re not comparing apples to oranges.

The CLF reporting that we have allows us to highlight where some of those pressure points are by using the same form, so if we see that it’s in. A pharmacy space. We see that it’s in primary care scheduling. ’cause we’re using that. We can, again, apple to apples, we can pull out what those pressure points are.

And then the guiding principles, again, that’s new for us this year, but a lot of great feedback thus far on that, that just, people are like, okay, cool. At least now I know how to kind of go about this and close some of these things out. So we’re all following the same thing. And Wendy’s not just, you know.

Getting it and closing it out in an hour and Tim has taken a day or two to actually try to reach somebody. So those have been big waves for us too. Alright, how to scale. This is what everybody’s here for. So maybe not really, but when we talk about value to the business, [00:21:00] which we’ll do in just a second, is we talked about this on that, that slide kind of with the arrows where we said, Hey, we solicited, we observed, you know, we engaged some of those teams, but, but we started in this consumer experience center, um, with about a 2000 c contact center and, and pulling this in, right?

So that started to. To get the buzz going about the value that this can bring into your organization. Okay, cool. If we’re just seeing this out of this small of a contact center, what would happen if we got it somewhere else? So what we were able to do is take those learnings that we had and we said, Hey, this is what we’re finding in the CXC.

I mean, we see a little bit about, you know, PE in there. We see a little bit about rev cycle in there. And so when we take that to our executives, they’re like, huh, okay, yeah. Let’s see if we could put that then in the rev cycle space, or let’s see if we can get some similar feedback. If we actually put that in that places.

That’s what helped us to the strategic deployment. So now when you’ve talked to these executives, and again, Tim mentioned like the telephony committee or the consumer sync or consumer leadership, that’s where those higher level VPs and and executives are making decisions. Based on the [00:22:00] recommendations that we’re getting out of this feedback that we, we had.

He’s taken it as an example to these meetings and putting it at that executive level where it’s easy for them to digest. It’s connecting the dots, it’s making it bite size so that they go, okay, yeah, this makes sense. We’re not making them weed through, they have access to dashboards. Y’all know your executives never log into Alia dashboard, you know that, but this is how they can get that buy-in is you have someone that’s advocating for it.

So. When we found some of those pressure points, that’s what led to this strategic deployment. And now this all feeds into our listening engine. So now we’re four years down the road and now we’re pumping it in. And now not only are we looking at the contact center, but we’re looking going, Hey, we have pressure points that they’ve mentioned other places, and we need to go get feedback in our chat channel.

We need to go get feedback in our digital channel because we really want them to self schedule, but why are they not? Let’s look in these different places to get the feedback that helps us paint that entire picture across our system. So. This doesn’t happen overnight. I think you all know that, but we’ll advocate for that.

That, I mean, we’re on year four of, of getting this to go, and it just takes some time depending on the, the size of your organization. We’re, we’re a pretty big [00:23:00] company, so of course it would take a little bit longer, but this is for us, how have we scaled this in Advent Health? Value to the business. A lot of us come here for value to the business.

Mark talked about this in the keynote where he’s like, Hey, we’re gonna make sure that you clearly understand what your value to the business is. On our slide, you don’t see a dollar or a cent. We care about the money. We do, but that’s not our main driver. When we look at this right now, the main driver for us is that Vision 2030 in our organization.

You can talk to any one of our executives, you could talk to our CEO, and that is. A constant in every one of the conversations that we have, whether it’s a town hall, whether it’s a motive, whether it’s one of these telephony committee meetings, or whether it’s a consumer sync meeting. Vision 2030 is known by, I would say everyone in the organization, but at least leaders and above.

It’s, it’s known in the organization and what you’re supposed to be doing. So for us, we are this post call survey and also the listening engine feedback in is it ties alignment to that vision. There will be an ROI that comes out of it. We just don’t have it in the dollars and cents yet. Right. Doesn’t necessarily mean it.

’cause at some point it’s not always about making money, but it’s about the [00:24:00] spending the money in the right places to get what you need out of it. One thing that I failed to mention when we were talking about maturity is we do have living lens. But it allows us to have that emotional connection to our consumer.

So one of the big ahas that we had is, and if anybody has a Medallia video, I have to, I’m gonna have to slow myself down when I say that. Sorry, Medallia. When you have this, and this was our preconceived notion when we went into this, we thought it was gonna be all your young people. And I mean, what do you know?

Everybody that’s in their maybe thirties or less that are, that are on TikTok, that are FaceTiming, that are doing a thing. AB are freaking lly. Not like there is, pick an age, pick a demographic. It does not matter. They are all there. If I had a dollar for every email in my inbox for one of our executives saying, Hey, can you find me a good video?

I mean, we actually now have a process where we spin ’em up every month so that they can see that. But yeah, that was huge for us.

Tim Frazee: I think what’s funny about that and was unexpected, I mean it’s a little off tangent, but is people are meeting you where they want to be met, right? So when they’re having those conversations with you.[00:25:00]

If they’re not sitting in their office chair, a lot of times they’re sitting on their black porch watching their kids. They’re sitting at their pool, they’re sitting at their coffee table, they’re in their car like they are giving real time feedback. And the age range is crazy. From 18 to 90. Yeah, we get video messages, which was absurd, and we never thought we would have that type of demographic or age variance.

Across the system or the participation that we see in that space.

Wendy Lustig: And I think this is big for healthcare too. When we think about, we’re always trying to build that brand trust, you’re trying to make that connection so that your patient feels like a person and not just another. Number in your system a picture is worth a thousand words.

Right? And I promise I’m, I didn’t study the Medallia video sales brochure when I came in here. Um, but that really does make an impact in that space. And for us, that was, that was a big piece that also drove the buy-in for the platform. ’cause once leaders saw that, and now they can use it in breakout sessions with their contact center and say, Hey look, Beth did a great job [00:26:00] today.

Look at this cool video. We actually did do a spin on it too, where we gave our team members a video. And said, Hey Beth, how? How did that feedback make you feel? So we got the consumer feedback and then the reaction from the agent too. That was really a cool full circle moment. So, long story short, those are value things to your business that you just have to spend money to get.

Additionally, it identifies pressure points that you think you know, but you don’t always know and quantify ’em as well. So. That was helpful to us because without that post-call survey, we wouldn’t have that view to be able to see those things. And then lastly, to us, the actionable feedback was huge.

Anybody in a contact center, you know this. If somebody’s mad, just tell me so I can fix it. Right? I, I care that you’re mad. I just get it to me so that I can fix it. Right? We didn’t always have that opportunity. So usually what would happen is. They would be upset and fester until they got to the next point in their journey.

So if they had a really bad contact center experience, it was hard as heck to schedule their appointments, but then they got to their doctor’s office, what are they saying to Dr. Smith? Well, dad, gum, it is really [00:27:00] hard to make a freaking appointment with you, right? Like I. That’s you and the contact center.

We didn’t know that the provider knew that, but that was really hard for us to create action on our side to make that a more seamless process without having that feedback. So again, value to the business isn’t always about dollars and cents. It is, but sometimes you have to spend money to make money. So for us, this is a big thing right now.

We will come at some point with the dollars and cents, but where we are in our journey is that’s not the main. Focus for us, right? Yeah. Yeah.

Tim Frazee: Just think about loyalty, retention, and satisfaction. Yeah. How do you get to those three measures?

Wendy Lustig: Alright, so this wasn’t all, you know, smooth gravy for us. There were some pressure points that we had, and these are some of the lessons that we learned with anything.

When you roll out a new post-call survey, there’s always competing priorities, right? If you’re an operational leader on the data side, the person building it, the boots on the ground, you’re like, yeah, cool. I put out this new survey for that operational leader. They’re like, ah, crying out loud. Now this is.

Added to the list of other priorities and they’re dealing with fires they’re putting out and other stresses, short staffed, lack of supplies, blah, blah blah. So that was [00:28:00] one that we had to compete against, just varying levels of experience and ownership. So as I mentioned about the post-call survey and what that structure was, this was the first post-call survey for some of our leaders.

So. They didn’t know what they didn’t know. That wasn’t a bad thing, but they just didn’t know, okay, so what do I do with this feedback? How am I supposed to use this? How do I tell this story to my executive? Some have been in businesses where this has been before, but this was one that we had to, and I think we still are overcoming as leaders get promoted in our organization, is just helping them understand what to do with this and that experience around it.

And

Tim Frazee: I would just say it was. A first time post call survey for folks where we were actually getting good concrete data versus press one for good experience, press two for bad experience, which was, you know, that’s early two thousands.

Wendy Lustig: Different processes for different teams. So again, sometimes people would take a few phone calls to follow up with a patient.

Sometimes they would do one. So just to kind of help. Break down some of those barriers and, and make that a consistent process where we can, but this is still ongoing. Another challenge was, is it was just, it was a phase rollout. I can’t roll out every contact center all at the same time. I’m good, but [00:29:00] not that good.

So, again, as, as people came on, it made sense. But that’s where my closed loop form kind of got hung up a little bit. ’cause I was more focused about getting people on the necessarily. Editing that every time a new department came on. So you do have some pressure points there of where, what do I prioritize to make sure everything’s going at the same time?

And then just alignment. I think this happens with everybody is just where is this on the priority scale? Where is this with how I showcase this and, and leader up to my executives? What’s next for Advent Health? We’ve obviously talked about our growth journey, but here’s what we’re, we’re exploring next is just looking at ways to increase the end, which is just survey participation.

I’m not saying response rate, I just wanna get this in front of more people. We wanna be solutioning. This is, is hopefully through Mindful, is our personalized Q callbacks, and then just deriving insights again. I mentioned that closed loop form that we did, that work group on starts on April 1st. So just arriving the new insights that we have now that we have some better alignment.

They went from, I’m not kidding, like 23, 25 options on that closed loop forum to about a hundred now. That they can pick combinations of to be able to tell their their business.

Tim Frazee: Yeah, and I’ll, I’ll just add, and we can obviously [00:30:00] wanna take some time for some questions, but you know, even before Mark and Sig were talking about the true voice of the consumer comes out of the contact center, that’s something that we’ve known for a long time now.

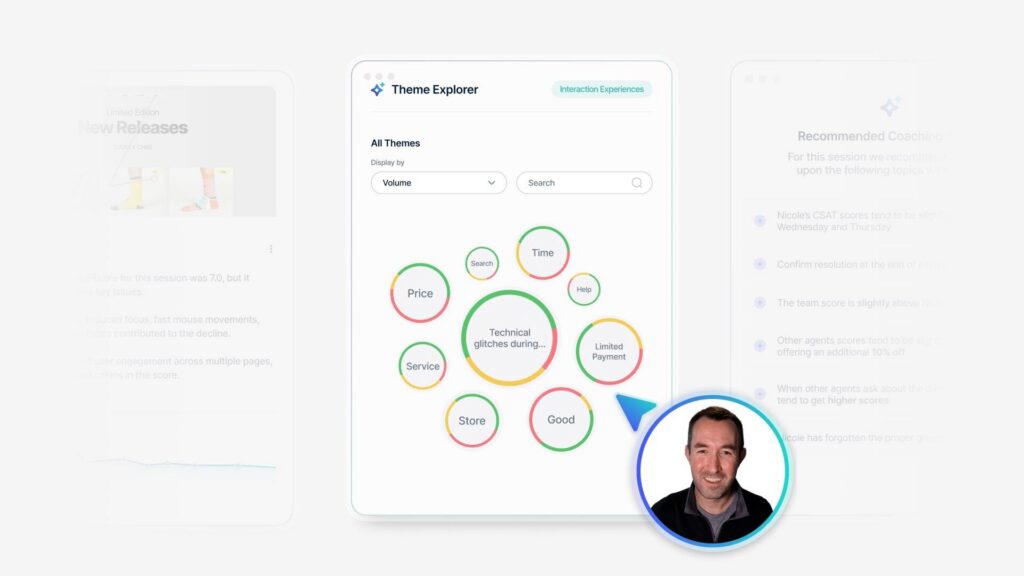

The surveys are just one avenue into the larger picture. Right? Um, so how do we use Medallia and some of our other tools to do the speech analytics, the text analytics, to really glean those insights to help us figure out. What’s actually happening on the call versus what we thought was happening on the call, right?

So at one point in time, we’re measuring 1% of our calls through a quality program. How do we get to measuring 90% of our calls, a hundred percent of our calls? Where are the things really happening that we always thought were, but I. Here’s a reality check of what’s actually happening here.

Q+A: So we, we help, I mean the company called Emcor cx.

We help companies kind of unleash the value of this, not the tech. You may have said this right at the beginning of the presentation, because that was a lot of information. You’re focused on the consumer, you’re focused on obviously the caregiver network that sits around it. Mm-hmm. Do you have centers that are focused on the [00:31:00] HCPs that also interact?

Tim Frazee: Like our community providers? Our community network providers? Yes.

Q+A: Yeah. Yes. We are listening to

Tim Frazee: their, to their feedback

Q+A: as well. Okay. So you have separate sets of feedback and then inter intermingling. Yes.

Q+A (2): Yeah.

Q+A: Unbelievable.

Q+A (2): I have some questions. It sounds like you guys are using survey a lot. Yeah. But what we’re asked a lot is to not look at survey and ingest the contact.

Mm-hmm. So I’m interested in how you guys are using that either. For categorization and or if you guys are doing that in terms of quality and automated scoring and things like that?

Tim Frazee: Mm-hmm. We are just dabbling in the automated quality management space. We have been on that journey a little bit with Medallia over the last 12 to 18 months, and that’s where the speech analytics, I.

Comes into play. Obviously in the world of healthcare, the language is challenging, whether it’s prescription or physician name, those can be convoluted to the technology as a whole. As that matures, so will our program. But really the, the ultimate goal is, is what you asked about. We know that the [00:32:00] majority of our feedback is gonna be funneled through the contact center from various other listening engine components.

Wendy Lustig: And we do leverage some of the manual quality management that we have today. ’cause we have a team that listens to calls. Right. But. Listen, stereotypical, less than 1%, yada, yada, yada. Right? And we do compare that to some of the insights that we get outta these closed loop. I would love to tell you that I audit every single, or I look at every survey, or I, if it’s an FIR equals no.

I go and I audit that. Um, we have that a little bit, but that is such a manual process. Where it gets lost is spending the human hours on it versus the bang for the insights that’s there. So we’re starting to get more robust in just some Power BI dashboards that are allowing us to tell that story between what is happening in quality versus what’s happening in Medallia to match those two things up.

’cause we don’t have those two systems connected as of yet. Why? Because we’re trying to see if we can get the right a QM solution in there versus spending and connecting potentially the not right system.

Q+A (3): How were you able to get the financial support before being able to [00:33:00] communicate the dollars and cents of your Yeah.

Return on investment? Well, I

Tim Frazee: kind of alluded to it before, so very adv Health is very governance based, right? So when we take things up through these consumer leadership channels, we have senior vice presidents that sit in finance, that help us facilitate the story and the need behind the product. So when we’re making collective decisions, we have leaders that sit in the clinical space, leaders that sit in the finance space, leaders that sit in the consumer space, and they’re making collective agreements.

Together on how we should approach the next endeavor. And that happened to be, uh, in the world of, you know, post-call surveys and really thinking about how we expand that across. You know, our 7,000 physician practices.

Wendy Lustig: To answer your question a little bit more directly, it started because in 2021 we had a VP that was new to our organization that said, I’m getting a post call survey and this is what I’m going to do.

That was the foot in the door, and then we’ve just built on it that VP’s no longer with our company, but we built on it then. So I think just [00:34:00] that moment in time of trying to build that one centralized also helped us get there because. The question that we’re not necessarily answering is, how did you get it from the start?

And that’s how we’ve got it. But that, that was just the, the seed. I mean, we’ve done a, a million times of work just to try to, you know, keep it going and, and show its value too. Yeah.

Tim Frazee: I would just say very intentional Yes. About being collaborative in that space. So we removed the silos because the silos existed a while ago, but it was, you know, um, our chief brand operator that basically said, no, I have to pull these people together.

Mm-hmm. I have to be the. Centricity of why we’re gonna make these changes and, and use my voice in this organization to help influence the finance teams, the clinical teams on why this is important, especially if our vision is to be a consumer focused organization by 2030. That brand household name.

Q+A (4): Hi.

This might be a similar answer to the one you just gave, but, uh, one of the things you mentioned in the lessons learned part was around. You know, you’re very excited to launch a new program, but getting everybody on [00:35:00] board mm-hmm. To actually do that. You mentioned, Wendy, the guardrails mm-hmm. That you had set up.

Please close this many alerts, please. Yep. Mm-hmm. You know, answer the case, the, the closed loop form. Yep. So what was, was it because you had that more top down alignment that kind of getting people to do those things? Or was it the insights that you were driving to get people to adopt it, to, how did, what was the change management process for actually.

Getting people to do the thing.

Wendy Lustig: Yeah, I think there was a realization, um, if anybody was here last year, vice President, Brandy West, um, did a session. She was with Chris from UAB as well. But it was basically they determined very quickly just that first interaction resolution. If it wasn’t done, the impact that it had to the brand.

We all act this way as a consumer. If I don’t get the answer, I went on the first time and I feel like, ignore, guess what? I’m calling you back or I’m peace out Cub Scout. Right. So that value was, was figured out pretty quickly. So with that, then it goes through these channels of, okay, top down consumer leadership.

But it’s not like they’re saying, you must do this. They basically say to us, how are you gonna make this better? And then from the bottom up we have to get alignment and say, okay, this is what everybody has [00:36:00] agreed to. Let’s, let’s go this route. So even though it’s guiding principles that I was talking about, I didn’t sit in a room and come up with those.

Yeah, we took that to that committee and said, Hey. Here’s commitments that we need to make to show that we’re invested in this and that we are committed to this and that we’re committed to the process. And seeing this through. Sometimes people don’t know what they know, so somebody throws out an idea and then we massage it a little bit and get to the number that we need to be, but that’s kind of how it came.

Additionally, what also supported that was. With that, I’m gonna say bad old, whatever closed loop form that we had, we could see the data, we could break it down by the number of hours that it took for them to close. And when all of a sudden you’re looking, you going, gosh, most of ’em are more than three days old.

Like, nope, this is way too long. Right. So just showing some of that behavior. Allowed that executive buy-in to happen too. Even though it’s a, it’s an old format, it doesn’t mean we capture everything I want. You could still get behaviors out of there that you as a, a leader in your org go, yeah, that’s not good.

We gotta change that. Yeah. So that, but it, it kind, it came top down, but I don’t wanna say it was like, I’m not like a Zeus like, Hey, you gotta do this. It’s, Hey, we, you guys as leaders need to figure out how you fix [00:37:00] this. And then it comes back bottom up.

Tim Frazee: Yeah. I’ll just add, I mean, I’ve worked for Advent for 25 years now, and I, I think from that company’s lens.

There’s a lot more bottom up than you would expect, right? So when we talk about boots on the ground, leaders that are doing the work day in and day out, they are the ones that are helping drive the story through the appropriate channels and then allowing our executive leaders to have that buy-in and make those decisions with our feedback.

We’ve just been very, very intentional over the last, probably five years or so on making sure that that is, uh, top of mind. And, and, and it’s the expectation. Every month we meet with senior leaders and the expectation is, what new do you have to bring to me to make a decision on,

Q+A (5): I, I know that we’re all here to focus on the customer experience.

Mm-hmm. But I’m wondering if you have any insights or you’re able to take action to improve. Your employee experience based [00:38:00] on the feedback from

Wendy Lustig: that

Q+A (5): you’ve

Wendy Lustig: been receiving? The most glaring example I have is with that Vidalia video example that I gave earlier, where from a corporate perspective, when I found those, I specifically reached out to those team members and I said, Hey, would you do a survey for me?

I wanna get your reaction to how this was. Now, admittedly, that’s not like a full blown process that happens every single month. But the cool thing was, is that was something that impacted them greatly. We don’t use Medallia as our employee experience platform. Um, and not every single department that was on that list earlier gives their frontline team members access to Medallia.

But the ones that do are in their self coaching. They’re in there looking for that feedback. They’re logging in every day.

Tim Frazee: I’ll just add the two ladies that are sitting right here are your boots on the ground operators that manage markets, and I’m calling them out because they will happily tell you what engagement levels their team feels from us activating on those particular platforms.

And is it a benefit for them? Do they feel more whole when we’re actually receiving feedback from the consumers, good [00:39:00] or bad? How do we use it from a coaching education standpoint? Do we use it from a retention standpoint? Absolutely. And I think they could easily fill in some additional questions for you.

Wendy Lustig: Alright, cool. Then we’ll let you guys go. Thank you so much for your time.