SHOW

Experience ’25

Watch keynotes, sessions, and more from Medallia's Experience '25 conference in Las Vegas.

Featured Episodes

“Oh My” — Meet Medallia’s Newest AI Features

Spotlight

Redefine Patient Trust Through Personalized Care

Industry Pulse

4 Ways to Look Beyond Surveys with Meta

Quick Takes

Experience ’25

S1: E43 - How CVS Health is Redefining Care

Experience ’25

S1: E42 - The Future of CX, with Sid Banerjee

Experience ’25

S1: E41 - Demonstrating CX Value: Strategies to Showcase Impact and ROI

Experience ’25

S1: E40 - Experience Keynote Highlight Reel

Experience ’25

S1: E39 - Revolutionize Experiences with Outcome-driven Transformation

Experience ’25

S1: E38 - Masterclass: Text Analytics 201

Experience ’25

S1: E37 - Loyalty Unlocked: The Art of Winning Lifelong Customers

Experience ’25

S1: E36 - Thriving Experience Ecosystems Begin in the Contact Center

Experience ’25

S1: E35 - Handling the Heat: How Frontline Teams Win High-Stakes Moments

Experience ’25

S1: E34 - From Customer-Obsessed to Industry-Leading CX

Experience ’25

S1: E33 - Text Analytics: The Unsung Hero to Propel Your Business Forward

Experience ’25

S1: E32 - The Untapped Secret to CX Success: Aligning EX and CX

Experience ’25

S1: E31 - Developing CX Maturity, Creating a Roadmap, and Driving CX ROI

Experience ’25

S1: E30 - Building Trust in Government: Efficient and Effective Service Delivery

Experience ’25

S1: E29 - Uncover What Customers Want: How Insights Impact Relationships

Experience ’25

S1: E28 - Redefining Customer Experience: Walmart’s Winning Strategies

Experience ’25

S1: E27 - Orchestrating Seamless Cross-Channel Experiences

Experience ’25

S1: E26 - Masterclass: Turning Closed-Loop Feedback into Business Impact

Experience ’25

S1: E25 - Trust Factor: Elevating Experience and Loyalty in the Digital Age

Experience ’25

S1: E24 - Masterclass: Designing Impactful Surveys

Experience ’25

S1: E23 - Masterclass: Raising Your Reporting Game

Experience ’25

S1: E22 - Masterclass: Text Analytics 101

Experience ’25

S1: E21 - Modernizing CX with Conversational Analytics

Experience ’25

S1: E20 - Mastering Digital CX: Insights from Leading Brands

Experience ’25

S1: E19 - Driving Action with Digital Experience Analytics

Experience ’25

S1: E18 - Driving Commercial Excellence through CX

Experience ’25

S1: E17 - Turning Athletes into Advocates Through Closed-Loop Feedback

Experience ’25

S1: E16 - Build Thriving Companies by Treating Employees as Internal Customers

Experience ’25

S1: E15 - Insights to Action: Client-Centric Decisioning for Business Success

Experience ’25

S1: E14 - Closing Listening Gaps with Creative Solutions for Real-Time Listening

Experience ’25

S1: E13 - Living Your Brand: Pathways to Culture and Brand Alignment

Experience ’25

S1: E12 - Breaking Down Silos: Practical Tips for Integrating Your CX & EX Strategies

Experience ’25

S1: E11 - Unlock the Power of Frontline Teams: Small Insights, Big Results

Experience ’25

S1: E10 - From Double Negative to Double Positive: PLDT’s CX Transformation

Experience ’25

S1: E9 - Masterclass: Beyond Surveys – Broadening Your Feedback Collection

Experience ’25

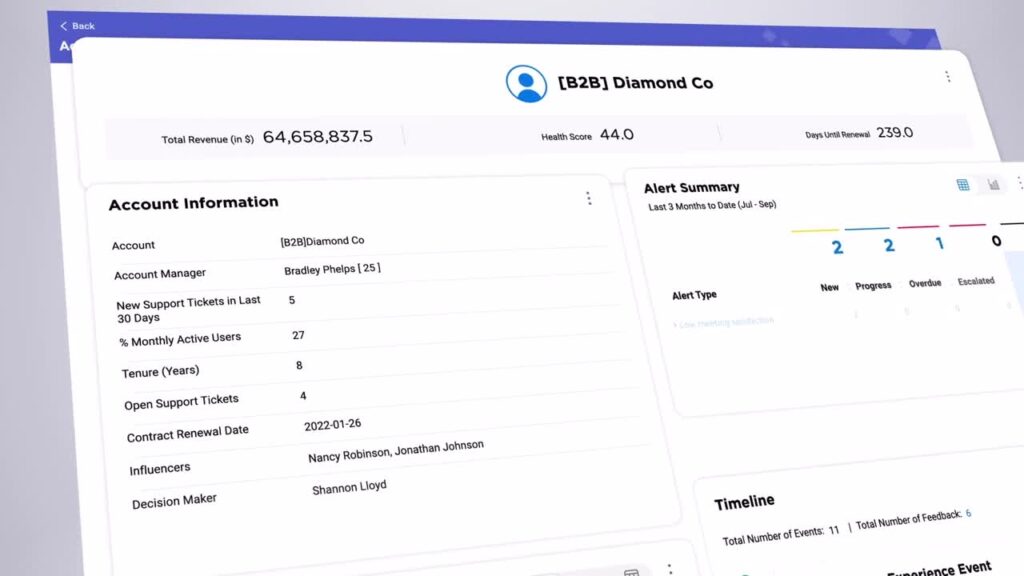

S1: E8 - Leveraging Predictive Account Health to Mitigate Churn

Experience ’25

S1: E7 - Locking in Loyalty: Key Insights from Medallia & Ipsos Research

Experience ’25

S1: E5 - Product Vision & Roadmap, with Fabrice Martin

Experience ’25

S1: E4 - Unleash the Power of Omnichannel, with Mark Bishof

Experience ’25

S1: E2 - Fusing CX and EX: Creating Unified, Purpose-Driven Experiences

Experience ’25

S1: E1 - Opening Keynote: A Vision for the Future

By the Numbers

S1: E5 - CX Leaders’ Views on Loyalty By the Numbers

By the Numbers

S1: E4 - Employee Experience By the Numbers

By the Numbers

S1: E1 - By the Numbers: Understanding Gen Z

Transformative Tech

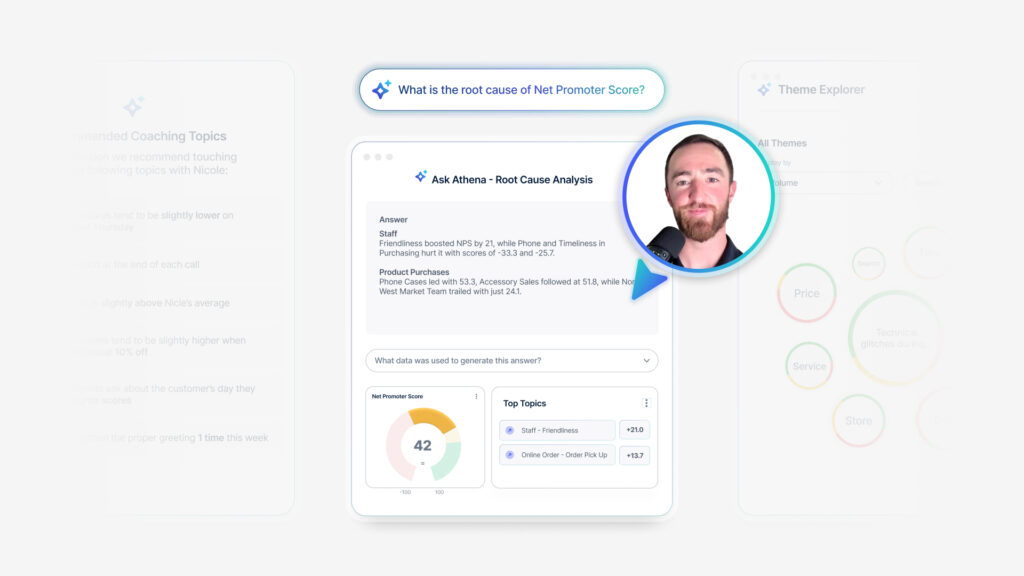

S2: E6 - Turn Data into Direction with Root Cause Assist

Transformative Tech

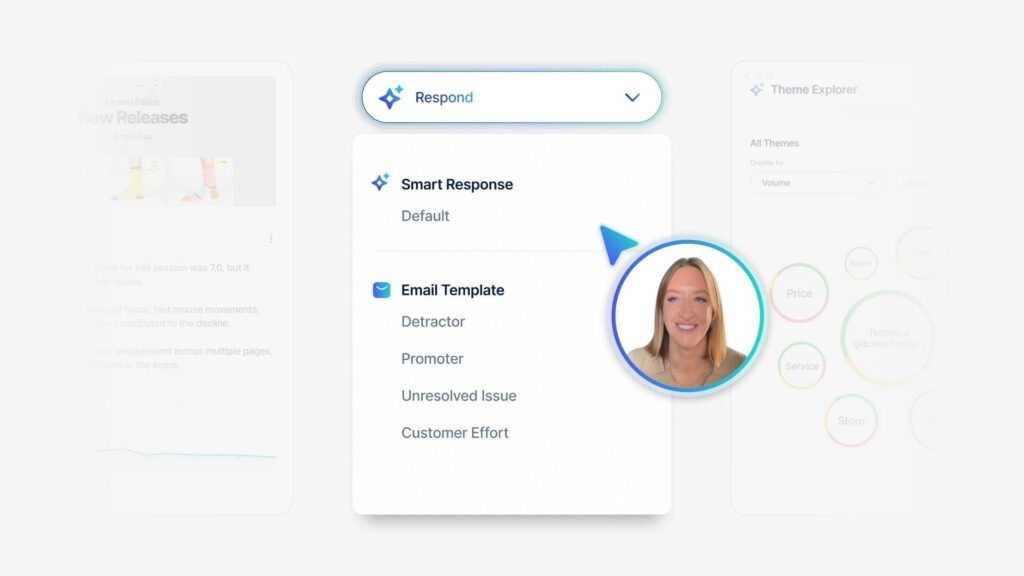

S2: E5 - Speed Through Responses with Smart Response

Transformative Tech

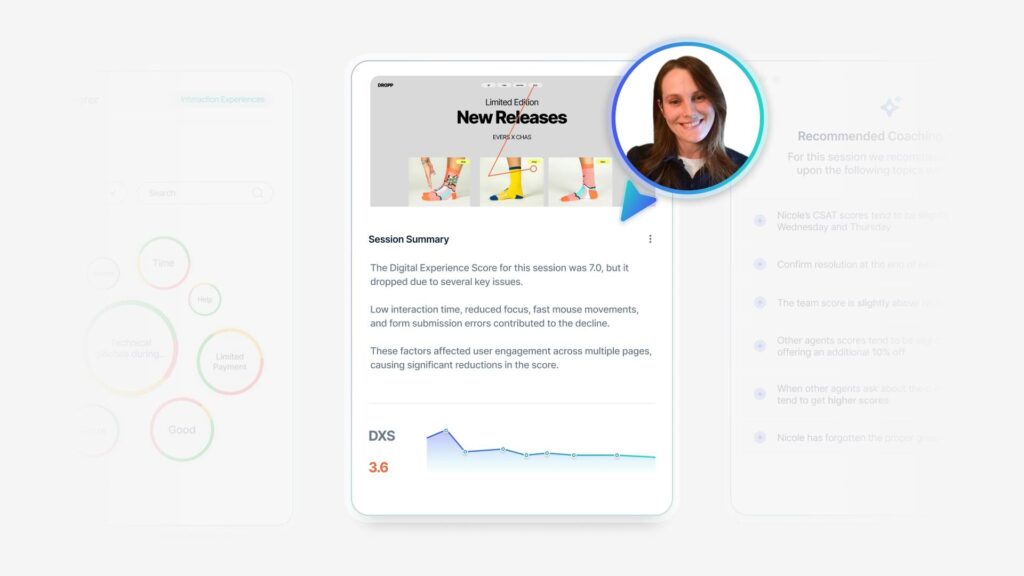

S2: E4 - Get AI-Powered Prescriptive Digital Insights & Session Summaries

Transformative Tech

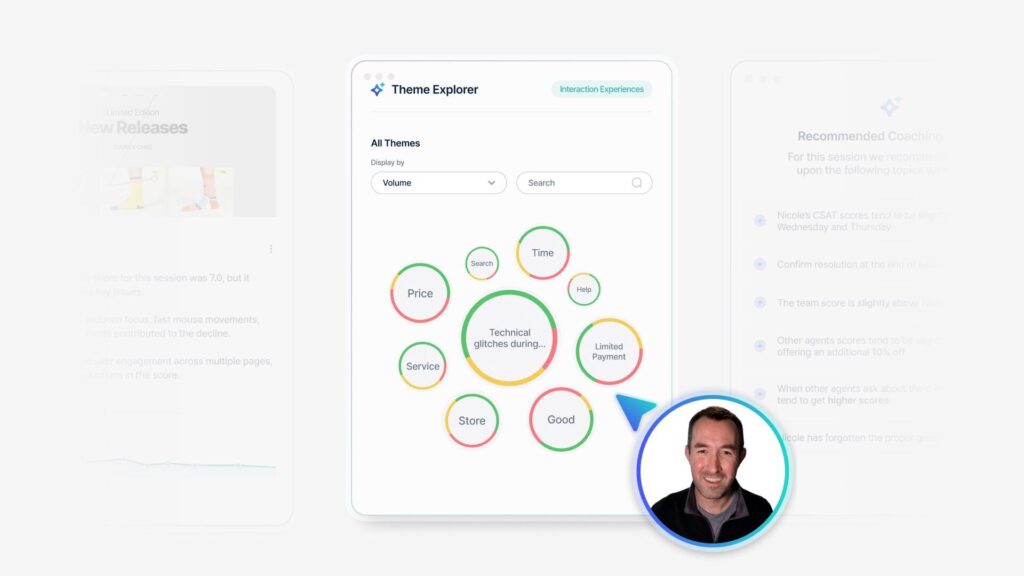

S2: E3 - Reduce Time to Insight with Themes with Generative AI

Transformative Tech

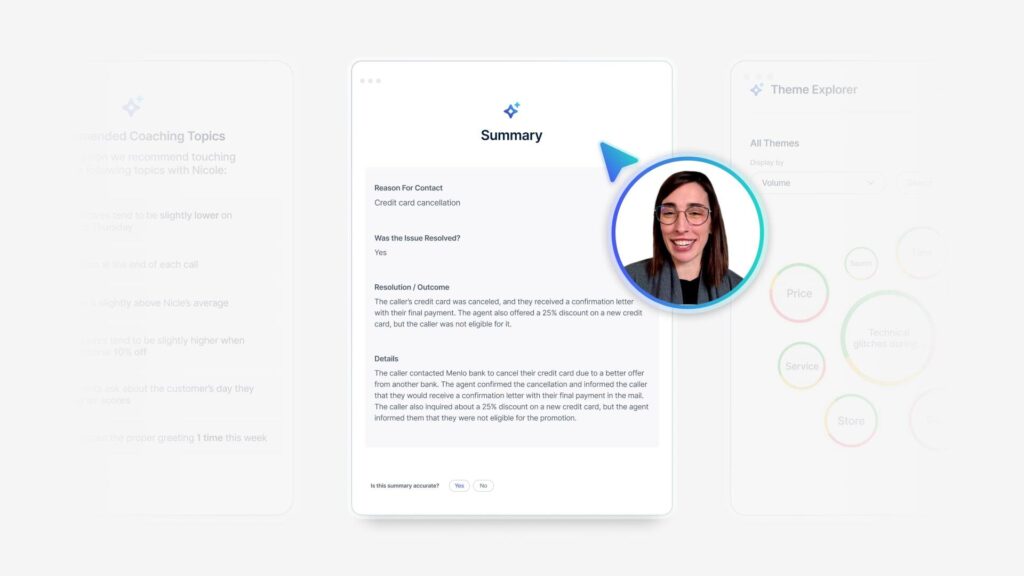

S2: E2 - Streamline Speech Analysis with Intelligent Summaries

Transformative Tech

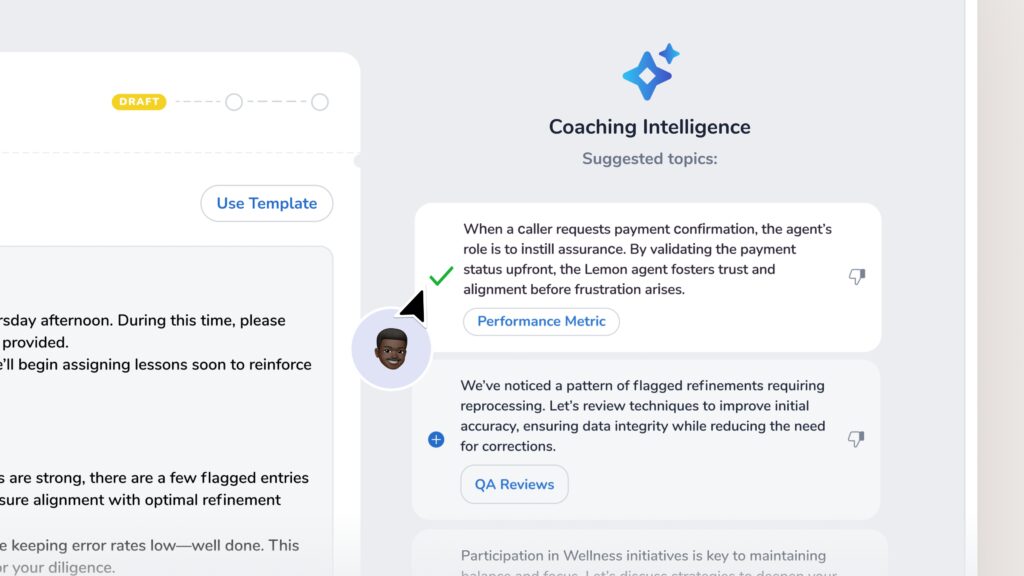

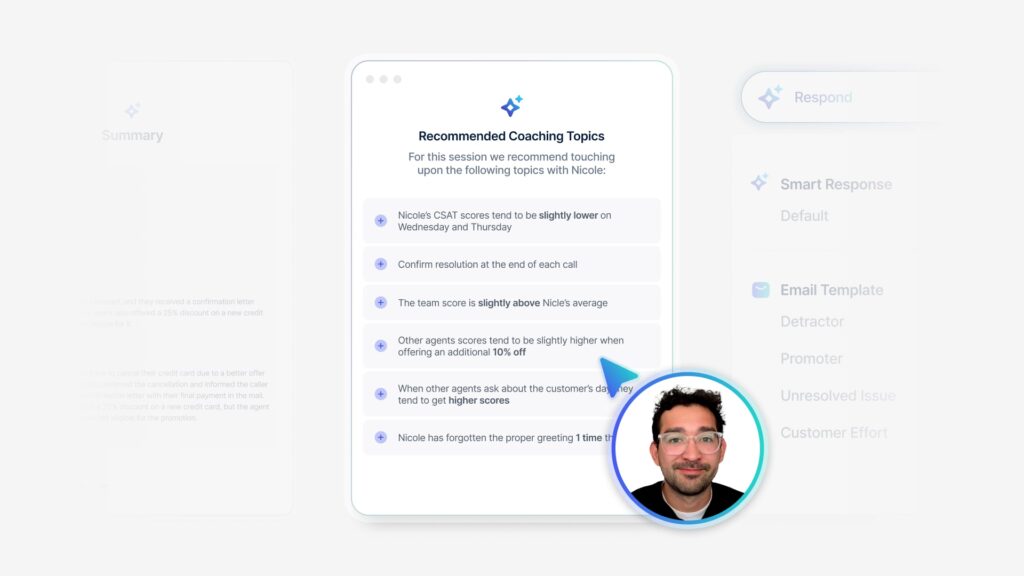

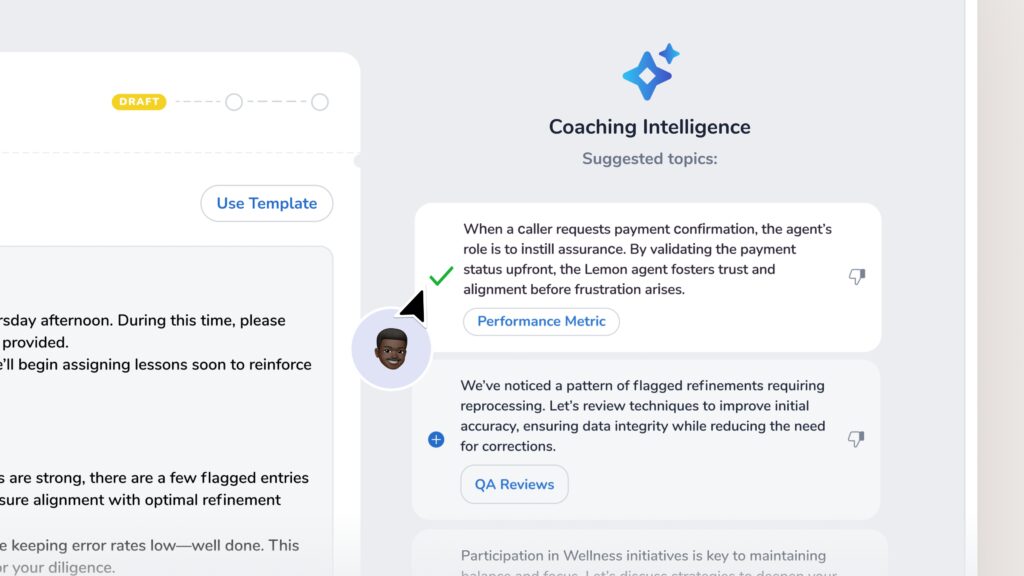

S2: E1 - Coach Smarter with GenAI-powered Coaching Intelligence

Transformative Tech

S1: E4 - Win Customers with Closed-Loop Automation

Transformative Tech

S1: E3 - Tell a Compelling Story with Video Feedback

Transformative Tech

S1: E2 - Personalize Digital Journeys at Key Moments

Transformative Tech

S1: E1 - Take Action on Employee Feedback

Quick Takes

S2: E4 - 4 Ways to Look Beyond Surveys with Meta

Quick Takes

S2: E3 - 5 Quick Takes on Successful Personalization

Quick Takes

S2: E2 - 4 Ways to Enhance Omnichannel Experiences

Quick Takes

S2: E1 - 5 Must-Haves for CX Success in 2024

Quick Takes

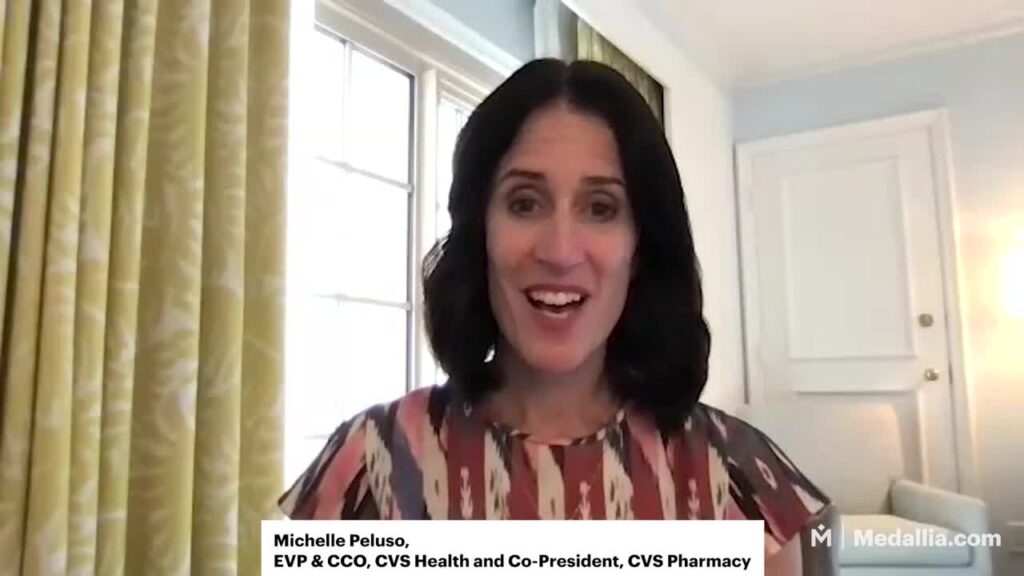

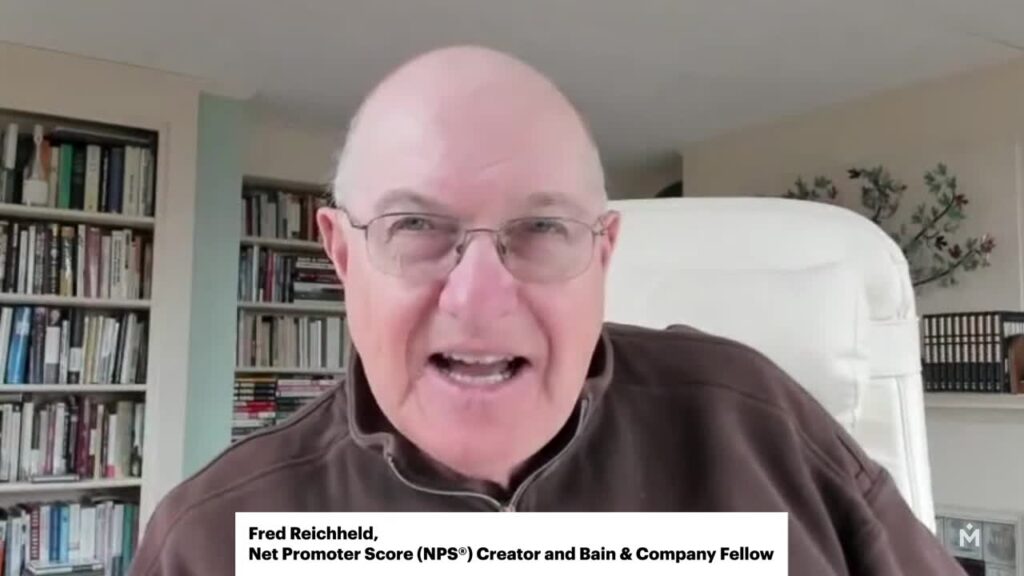

S1: E9 - 3 Ways Feedback Drives Customer Love with Fred Reichheld and CVS

Quick Takes

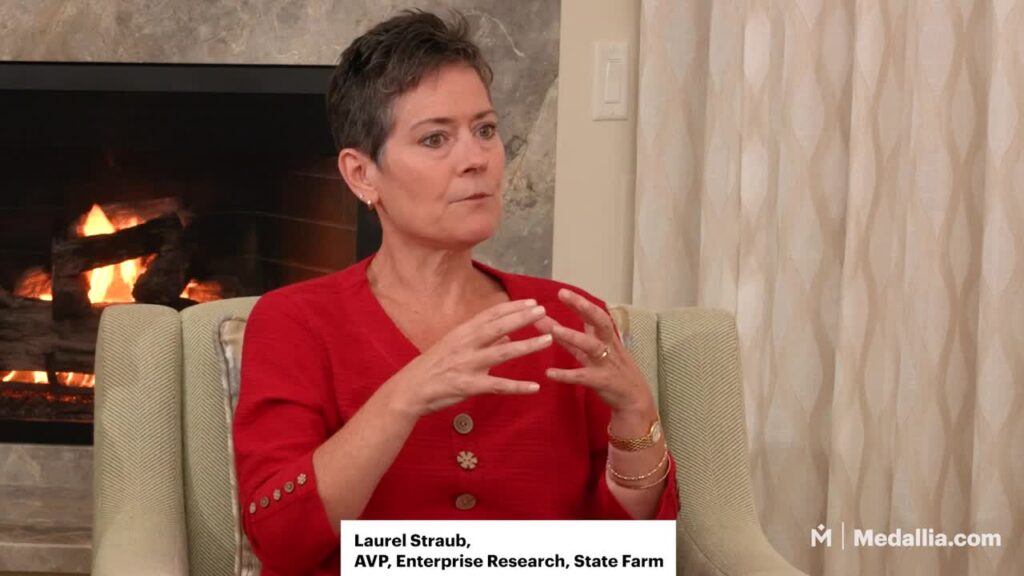

S1: E8 - 4 Insights Into State Farm’s Connected Experience

Quick Takes

S1: E7 - 3 Reasons Feedback Is Crucial to Creating an Outstanding Culture

Quick Takes

S1: E6 - 5 Ways to Advance Your Employee Listening Strategy

Quick Takes

S1: E5 - 4 Ways to Deepen Your Understanding of the Customer with Michelle Brigman

Quick Takes

S1: E4 - 3 Things to Know About the Experience of Inflation for Customers

Quick Takes

S1: E3 - 4 Tips to Creating a Connected Experience with DICK’S Sporting Goods

Quick Takes

S1: E2 - The 3 Layers of State Farm’s Digital Transformation

Quick Takes

S1: E1 - 3 Reasons Why You Should Measure Earned Growth with Fred Reichheld

EPISODE

Volvo Cars Unifies Consumer Experience Through “One Voice” Program

See how Volvo Cars introduced the “One Voice," their cutting edge VoC program.

Collections

Spotlight

S2: E11 - CX Day: Medallia Employees Share Why They Love CX

Spotlight

S2: E10 - Ride the Wave with Sarah Hauser and Medallia

Spotlight

S2: E8 - “Oh My” — Meet Medallia’s Newest AI Features

Spotlight

S2: E7 - CX Day: Why Do You Love Being a CX Professional?

Spotlight

S2: E6 - A 60-Second Look at Total Experience Profiles

Spotlight

S2: E5 - A 60-Second Look at Activating Your People

Spotlight

S2: E4 - Banner Health Innovates Patient Experience with Medallia

Spotlight

S2: E3 - Pip Hare Relies on Infinite Tuning

Spotlight

S2: E2 - BAC Reimagines Banking with Medallia

Spotlight

S1: E9 - H&R Block Activates Every Employee with Medallia

Spotlight

S1: E8 - A Closer Look at the #1 Enterprise Experience Platform

Spotlight

S1: E7 - Volvo Cars Unifies Consumer Experience Through “One Voice” Program

Spotlight

S1: E6 - MotoAmerica Partners with Medallia to Put on a Great Show

Spotlight

S1: E5 - Best Western Understands What Matters Most with Medallia

Spotlight

S1: E4 - Medallia and McLaren, a Winning Combination

Spotlight

S1: E3 - Fix Problems Before They Happen and Make Experiences Extraordinary

Spotlight

S1: E2 - CX Day: Customer Experience Pros Share Why They Love CX

Spotlight

S1: E1 - Pip Hare and Team Medallia Have Big Plans for Vendee Globe

Medallia Talks

S2: E2 - Strategies for Impactful Experiences with KPMG

Medallia Talks

S2: E1 - Boosting CX Impact through Personalization ft. Walgreens & Fred Reichheld

Medallia Talks

S1: E8 - Medallia + Adobe: How to Boost Digital Conversion through Personalization

Medallia Talks

S1: E7 - Medallia Talks with CVS Pharmacy, Inc

Medallia Talks

S1: E5 - The Future of CX: Re-Orienting Digital and People Strategies Around the Customer

Medallia Talks

S1: E4 - Medallia Talks ‘Experience Excellence’ with State Farm

Medallia Talks

S1: E3 - How UMB Used Speech Analytics to Reduce Costs and Improve Customer Experience

Medallia Talks

S1: E2 - How to Drive a Luxury Brand Experience That Builds Loyalty

Medallia Talks

S1: E1 - Medallia Talks with Fred Reichheld and Leslie Stretch

Industry Pulse

S1: E9 - What’s Trending in Feedback Management

Industry Pulse

S1: E7 - Preview the Future of Personalized Travel Experiences

Industry Pulse

S1: E6 - Blend Intuition and AI for Retail Success

Industry Pulse

S1: E5 - Lean on the Outer Loop for FinServ Success

Industry Pulse

S1: E4 - Unlock the Last White Space in CX with EX

Industry Pulse

S1: E3 - Harness AI for Personalized Telco Solutions

Industry Pulse

S1: E2 - Transform Government through Anticipation and Action

Industry Pulse

S1: E1 - Redefine Patient Trust Through Personalized Care

Recent Releases

Fusing CX and EX: Creating Unified, Purpose-Driven Experiences

Experience ’25

Personalize Digital Journeys at Key Moments

Transformative Tech

Preview the Future of Personalized Travel Experiences

Industry Pulse

A 60-Second Look at Activating Your People

Spotlight